McKinsey research has proven that insurance companies with better customer experiences grow faster, and more profitably. And, in 2016, 85% of insurers reported customer engagement and experience as a top strategic initiative for their companies. Yet the insurance industry continues to lag behind other industries when it comes to meeting customer expectations, inhibited by complicated regulatory requirements and deeply entrenched cultures of “business as usual.”

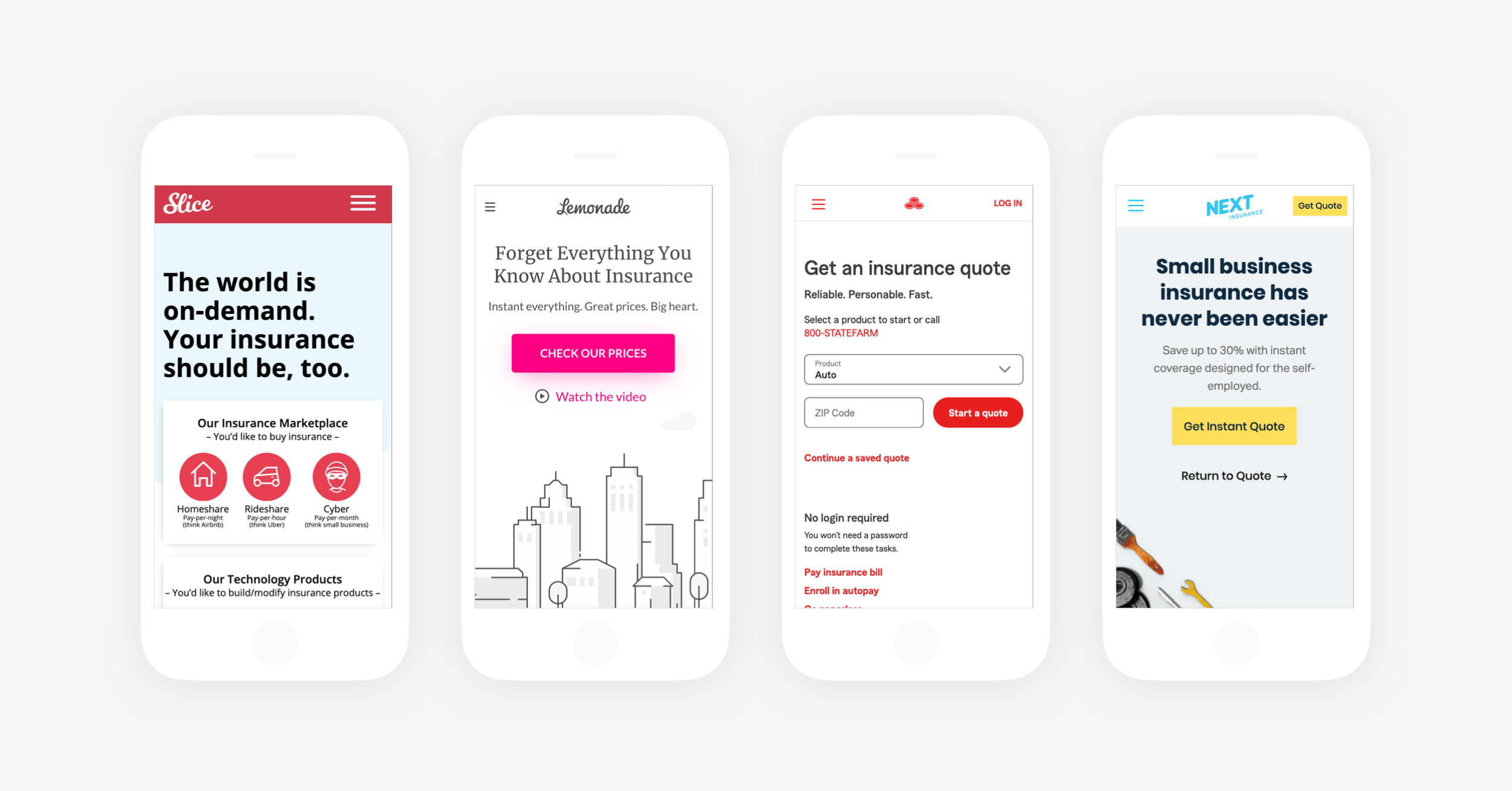

Some companies–many of them startups–are setting the gold standard when it comes to customer experience in insurance, and are paving the way for the industry’s biggest insurers to either fall in line, or risk losing out to smaller competitors with better experiences. Through a combination of new business models, clever uses of emerging technology, and deep understandings of customer journeys, these four companies are leading the pack when it comes to delivering on fantastic experiences:

1. Slice – Creating new insurance products for new realities.

Slice launched earlier this year and is currently operating in 13 states. Their business model is based upon the understanding that in the new share economy, the needs of the insured have changed dramatically, and that traditional homeowner’s or renter’s insurance policies don’t suffice for people using sites like AirBnB or HomeAway to rent out their homes.

According to Emily Kosick, Slice’s Managing Director of Marketing, many homeshare hosts don’t realize that when renting out their homes, traditional insurance policies don’t cover them. Then when something happens, they are frustrated, angry and despondent when they realize they are not covered. Slice’s MO is to first create awareness around this issue, and then offer a simple solution. In doing so, they are able to at once establish trust with consumers, and give them something they want and need.

Slice provides homeshare hosts the ability to easily purchase insurance for their property, as they need it. Policies run as little as $4 a night! Their on-demand model allows hosts renting out their homes on AirBnB or elsewhere to automatically (or at the tap of a button) add an insurance policy to the rental that will cover the length of time–up to the minute–that their home is being rented. The policy is paid for once they receive payment from the renter, ensuring a frictionless transaction that requires very little effort on the part of the customer.

Slice’s approach to insurance provides an excellent example of how insurers can strive to become more agile and develop capacities to launch unique products that rapidly respond to changes in the market and in customer behavior. Had large insurance companies that were already providing homeowner’s and renter’s insurance been more agile and customer focused, paying attention to this need and responding rapidly with a new product, the need for companies like Slice to emerge would have never have arisen in the first place.

2. Lemonade – Practicing the golden rule.

In a recent interview, Lemonade’s Chief Behavior Officer, Dan Ariely remarked that, “If you tried to create a system to bring about the worst in humans, it would look a lot like the insurance of today.”

Lemonade wants to fix the insurance industry, and in doing so they have built their business model upon behavioral premise supported by scientific research: that if people feel as if they are trusted, they are more like to behave honestly. In an industry where 24 percent of people say its ok to pad an insurance claim, this premise is revolutionary.

So how does Lemonade get its customers to trust them? First by offering low premiums–as little as $5 a month–and providing complete transparency around how those premiums are generated. They can also bind a policy for a customer in under a minute. Furthermore, Lemonade has a policy of paying off claims quickly–in as little as three seconds–and without question, a far cry from how most insurance companies operate today. And when claims are not resolved immediately they can typically resolved easily via the company’s chatbot, Maya, or through a customer service representative. But perhaps the most significant way that Lemonade is generating trust with its customers is through its business model, which, unlike other insurance companies, who keep the difference between premiums and claims for themselves, Lemonade does not profit off of unpaid out claims. Instead, any leftover money that is not paid out (they only take 20% of the premium as profit) is donated to a charity of the customer’s choosing. In fact, Lemonade just made its first donation of $53,174 last week.

Lemonade’s approach to insurance is, unlike so many insurers out there, fundamentally customer-centric. But CEO Daniel Schreiber is also quick to point out that although Lemonade donates a portion of its revenues to charities, its giveback is not about generosity, it is about business. If Lemonade has anything to teach the industry it is this: that the golden rule of treating others as you want to be treated, holds true, even in business.

3. State Farm – Anticipating trends and investing in cutting edge technology.

The auto insurance industry has been one of the fastest to adapt to the new customer experience landscape, being early adopters of IoT (internet of things), using telematics to pave the path toward usage-based insurance (UBI) models that we now see startups like Metromile taking advantage of. While Progressive was the first to launch a wireless telematics device, State Farm is now the leading auto insurer, its telematics device being tied to monetary rewards that incentivize drivers with money to drive more safely. They also have a Driver Feedback app, which, as the name suggests, provides drivers feedback on their driving performance, with the intent of helping drivers become safer drivers, which for them, equals money.

By anticipating a trend, and understanding the importance of the connected car and IoT early on, State Farm has been able to keep pace with new startups, and has reserved a seat at the top–above popular auto insurers like Progressive and Geico–at least for now. If nothing else, unlike most traditional insurers, auto insurance companies like State Farm and Progressive have been paving the way for the startups when it comes to innovation, rather than the other way around. And for now, this investment in customer experience is paying off, J.D Powers 2017 U.S Auto Insurance Study showing that even as premiums increased for customers in 2017, overall customer satisfaction has skyrocketed to a historical high.

4. Next Insurance – Automating for people, and for profit.

Next Insurance believes that a disconnect between the carrier and the customer is at the heart of the insurance industry’s digital transformation problem. In essence, it’s a communication problem, according to Sofya Pogreb, Next Insurance CEO. The people making decisions in insurance don’t have contact with the end customer, and so while they are smart, experienced people, they are not necessarily making decisions based on the actual customer needs.

Next Insurance sells insurance policies to small business owners, and their goal is to do something that they believe no other insurer is doing–using AI and machine learning to create “nuanced” and “targeted” policies to meet the specific needs of small business owners.

An important aspect of what makes their approach unique is that instead of trying to replace agents all together, they are more interested in automating certain aspects of what agents do, in order to free up their expertise to be put to better use:

“I would love to see agents leveraged for their expertise rather than as manual workers,” Pogreb told Insurance Business Magazine. “Today, in many cases, the agent is passing paperwork around. There are other ways to do that – let’s do that online, let’s do that in an automated way. And then where expertise is truly wanted by the customer, let’s make an agent available.”

While innovative business models and cutting-edge technology will both be important to the insurance industry of the future, creating fantastic customer experiences ultimately requires one thing: the ability for insurance companies–executives, agents, and everyone in between–to put themselves in their customer’s shoes. It’s is a simple solution, but accomplishing it is easier said than done. For larger companies, to do so requires both cultural and structural change that can be difficult to implement on a large scale, but will be absolutely necessary to their success in the future. Paying attention to how innovative companies are already doing so is a first step; finding ways to bring about this kind of change from within is an ambitious next step, but should be the aim of every insurance company looking to advance into the industry of the future.

White Paper

Transform Digital Culture and Improve Customer Experience

Learn more about how you can bring about the kind of cultural and institutional change needed to deliver true value to your customers