Design an insurance product that helps Millennials think about insurance in a new way

Recently surpassing Baby Boomers as the largest living generation, Millennials represent more than a niche market for insurance companies. In fact, they are now the industry’s primary customer. Yet despite their predominance recent research found that 80% of Millennials say they would move their insurance business to new entrants that are capable of creating and delivering more value than incumbent insurers. In short, Millennials don’t like insurance.

In its pursuit of the Millennial consumer, insurers have leaned heavily upon digital transformation efforts that are both slow and laborious, making little traction toward improving Millennial perceptions of insurance. We wanted to dig deeper into the Millennial mindset to understand what it is that Millennials don’t like about insurance and design a product that would transform the way they think about insurance.

Millennials value insurance, but they don't want to buy it

4 %

agreed that insurance is worth every penny

38 %

said they buy insurance because they "have to"

42 %

believe that insurance is necessary for them and their families

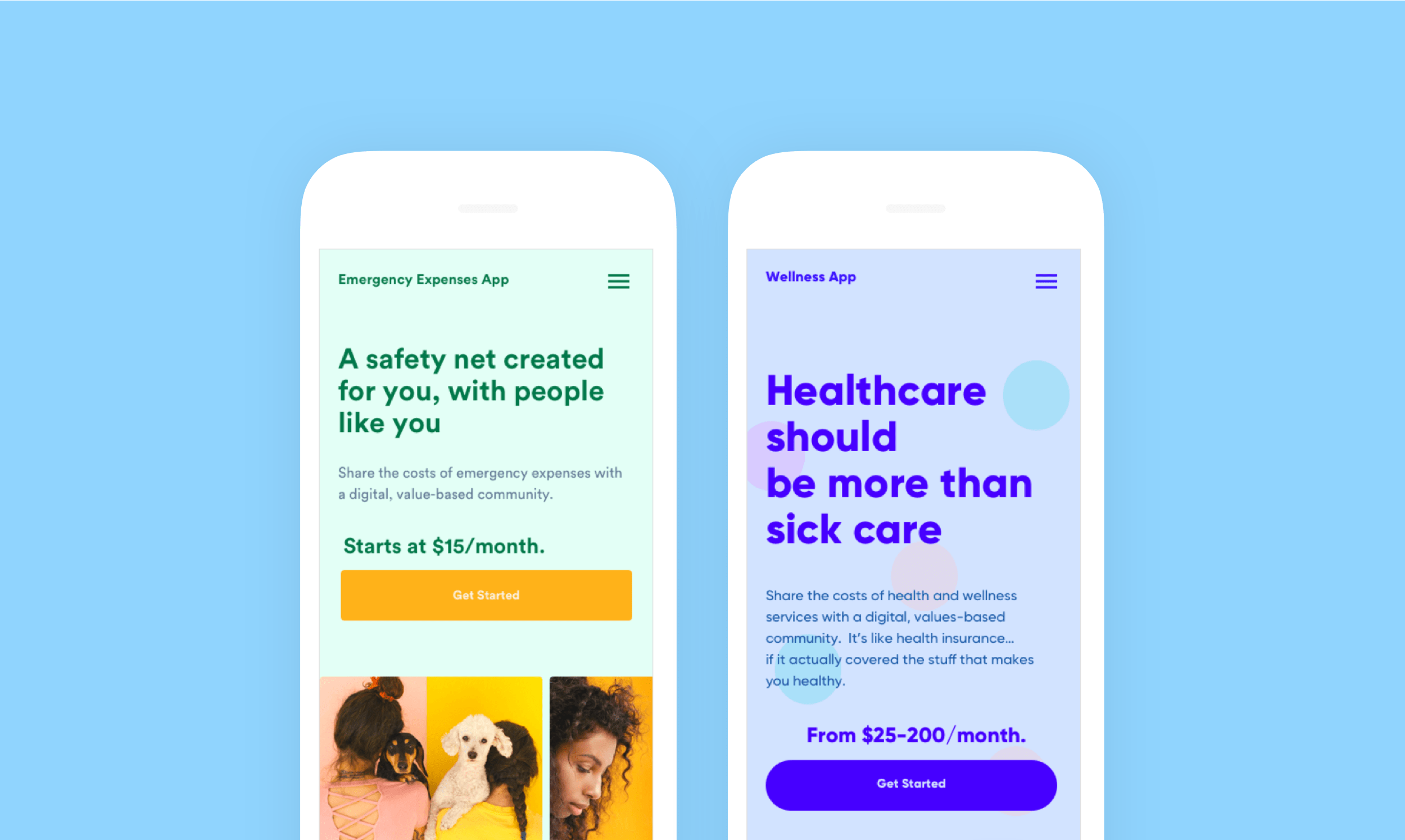

Our hypothesis

While we found that Millennials value the security and stability insurance promises, insurance doesn’t feel worth the money until something bad happens, and even then getting a policy to pay out can be a headache. So we thought: how can we make insurance feel valuable to Millennials, even if they never have to use it? Our theory was that if we could surface the community aspect of insurance by demystifying how it works–showing Millennials how the money they pay in insurance premiums goes to support other members of their community or network–we could make insurance not only more transparent and community-oriented, but also make it feel more valuable in the short term. Even if you never use your insurance, the money you are putting into isn’t being wasted, it’s helping other people – and you can see how.

We spoke with hundreds of Millennials to design two insurance products that would put our hypothesis to the test and reveal whether we could change the way Millennials think about insurance.

“This is a very cool idea. It’s like modern-day insurance.”

Meghan B,. Cake & Arrow Research Participant

Values must be more than a message. They need to be core to the product.

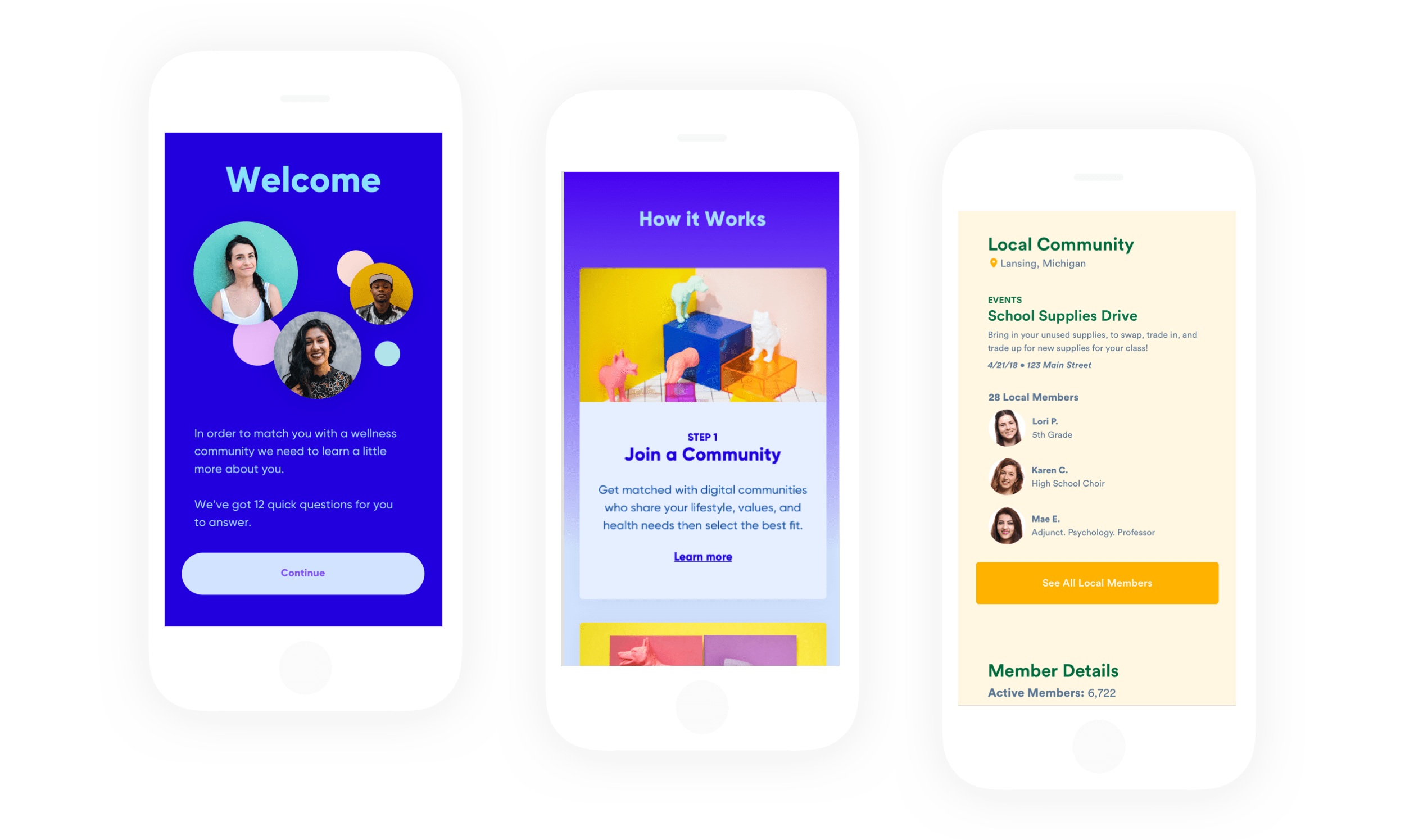

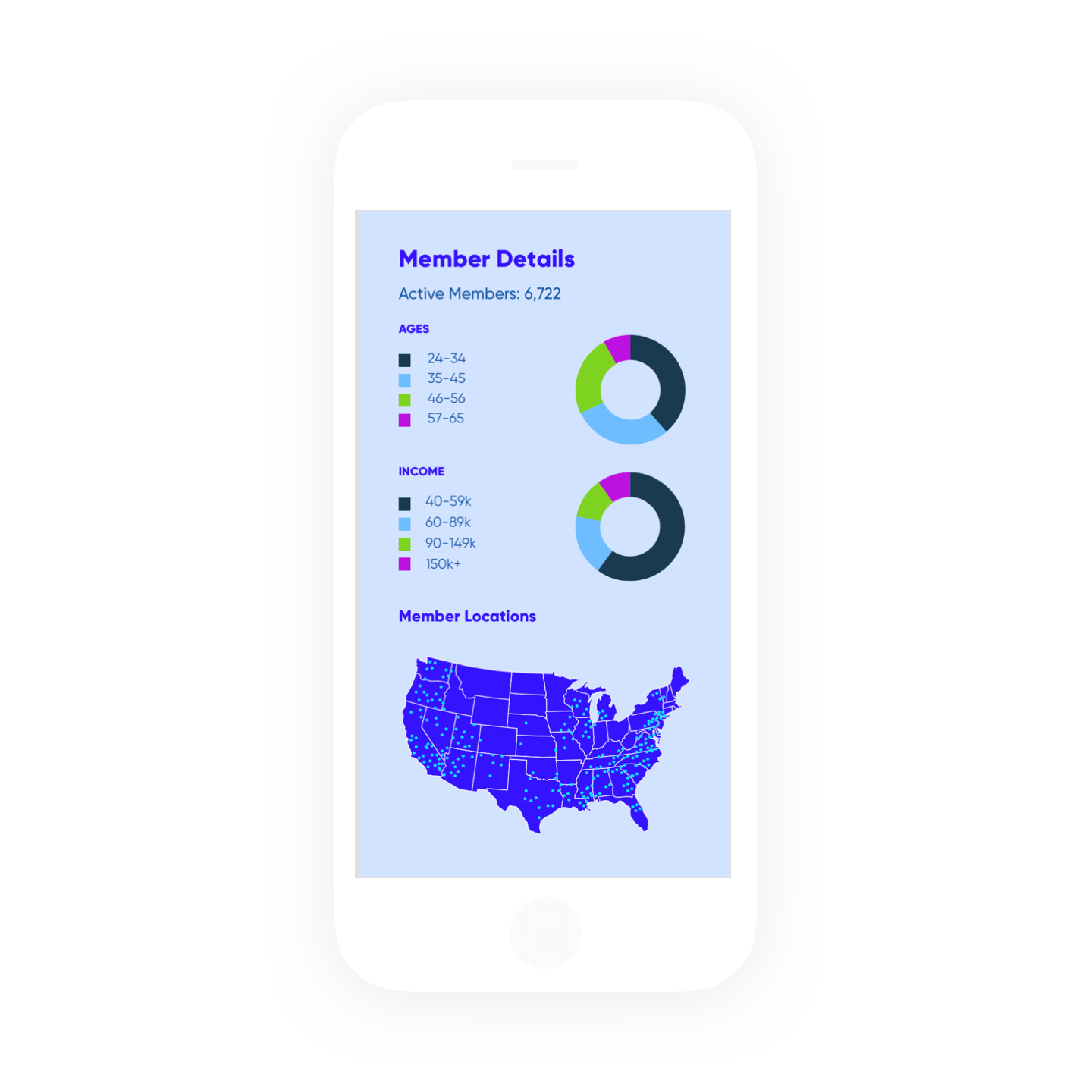

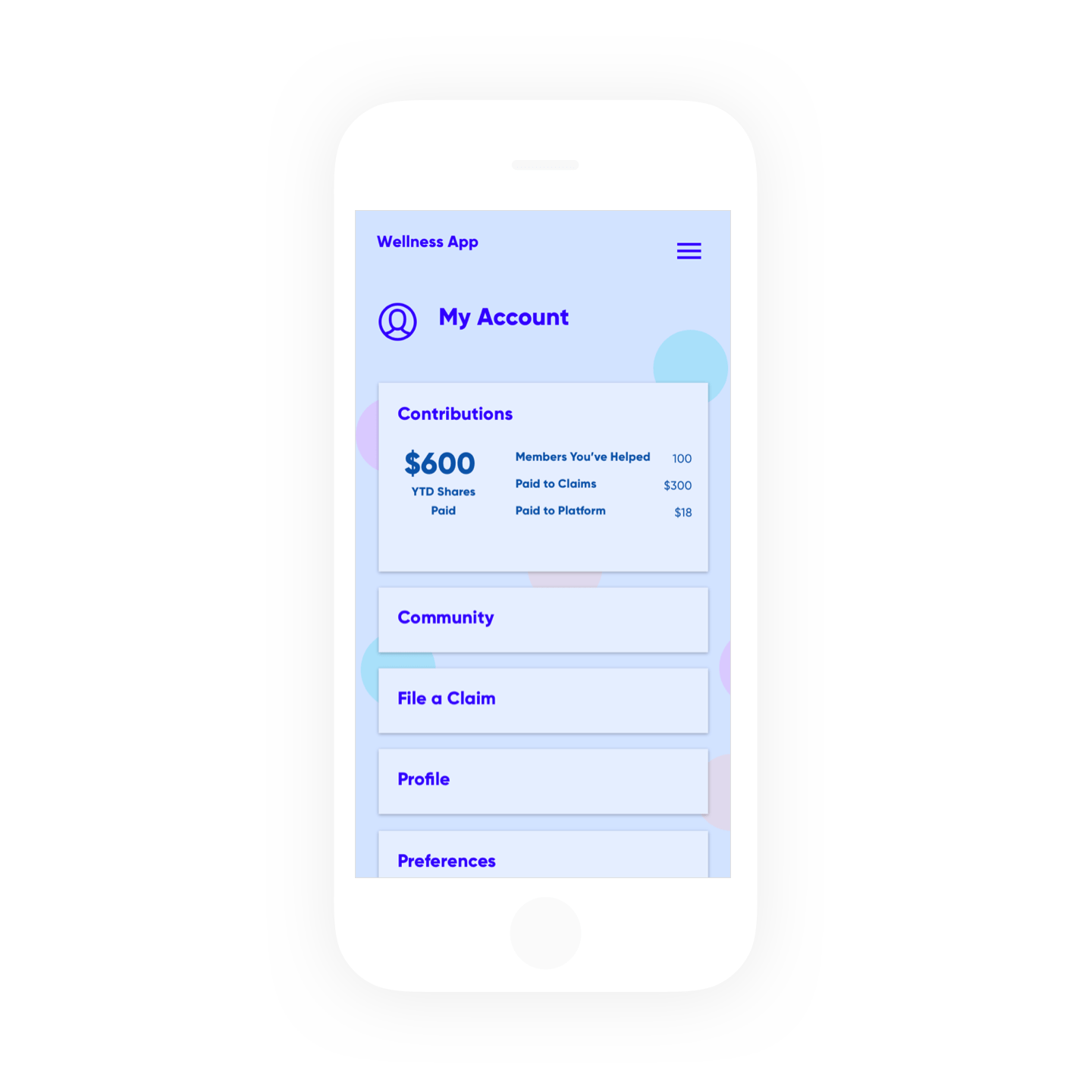

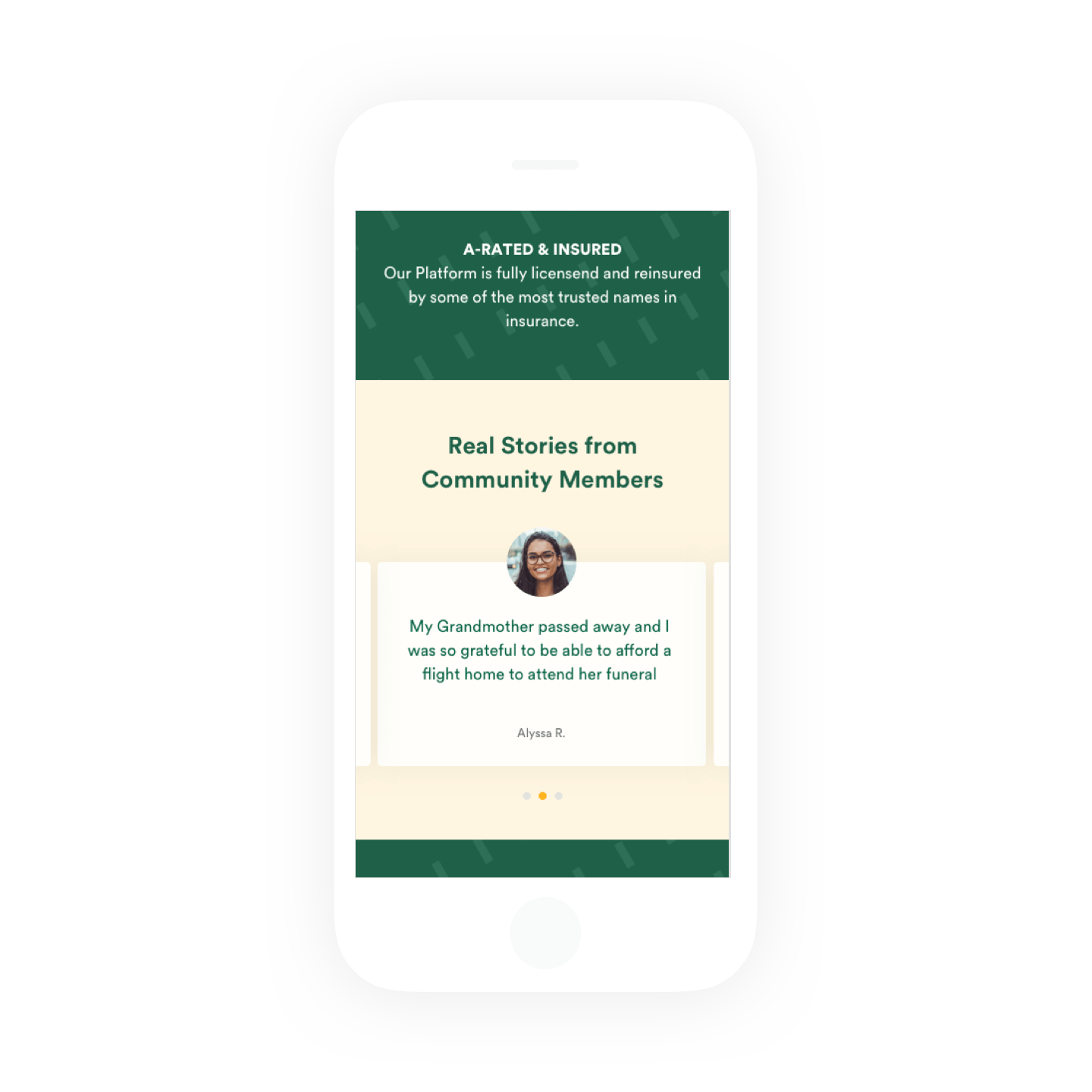

Millennials are skeptical of marketing messages. It’s easy to say that a product is community based or peer-to-peer, but until proving it to customers, it’s fake news. We created experiences that showed the impact of participation by sharing member stories and exposing the number of members their individual contributions had helped. In this way the community became real for our research participants.

Finding

Many participants were skeptical of the idea of community at first. Reading community funded was not the same as seeing the community in action. Seeing the impact of their contribution made the service come to life for participants, proving that the community was real, not just a message.

“When I first saw community I wasn’t sure, but seeing all of this really makes it feel real— like I’m really helping.”

Erin S., Public School Educator

Trust is earned, not assumed. Millennials need proof that data sharing is safe and worthwhile.

Millennials are increasingly wary of surrendering data and personal information. To access Millennial data, companies need to first earn their trust, not only by making data sharing valuable to customers, but by giving customers control over how their data is used. We created experiences that made sharing personal information valuable to customers and to the community at large while also providing users options to engage with the experiences without surrendering their privacy.

Finding

Participants wanted detailed information on privacy controls prior to signing up. Once they saw the value of sharing data and personal information and realized that they were in control of what was shared, they were happy to exchange information, and enjoyed the insights provided by the community.

“Can I decide what people see? I’d want to look around and try it out before giving away a lot of personal details.”

Esther R., Cake & Arrow User Research Participant

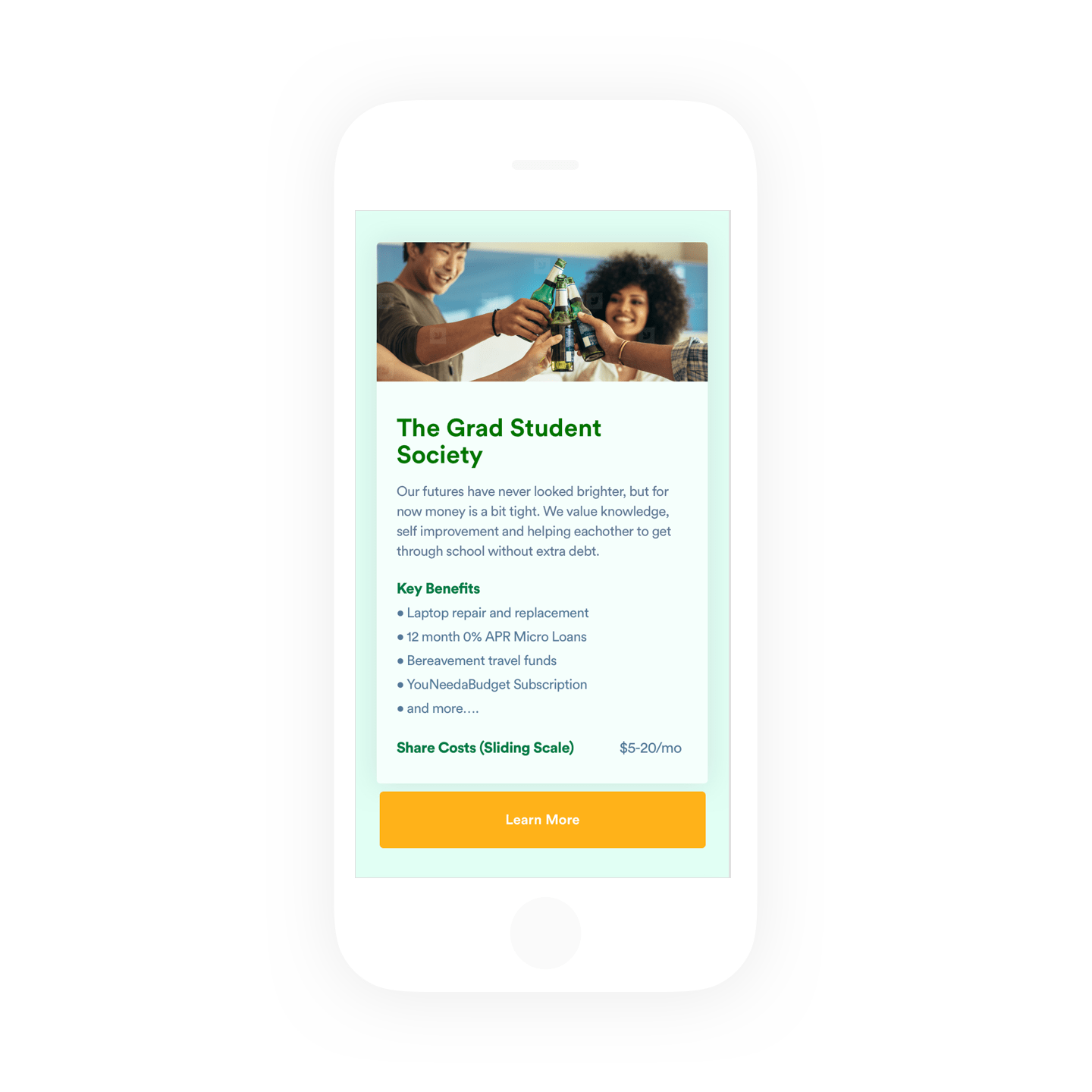

Shared identity is a basis for trust.

Millennials are more willing to share costs when they know their money is going toward people who share their values. The more we connected products and services to aspects of a customer’s identity, the more people felt good about sharing costs with others in their community group.

Finding

In our first round of research, communities were based on benefits for specific financial profiles. This type of community did not resonate with our participants. In our second round of research we customized the communities to connect more deeply to values and identities. Participants were engaged, excited, and overwhelmingly more positive.

"I would definitely trust other graduate students to use this responsibly.”

Luis G,. Graduate Student

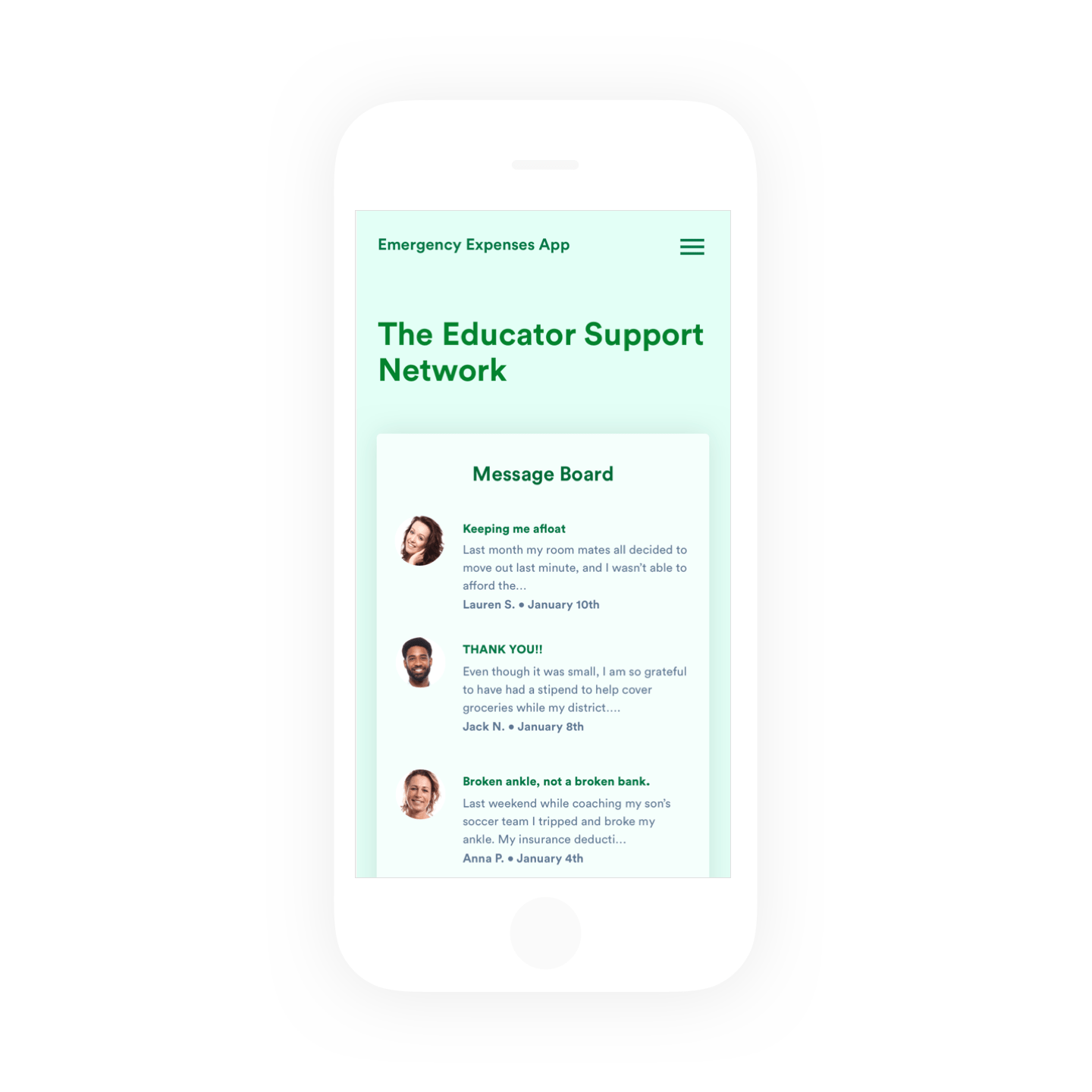

Helping others makes insurance feel more worthwhile.

Millennials find value in helping others. Traditionally, insurance only delivers value when something bad happens. By surfacing the community, insurance “pays out,” whether something bad happens or not. In the experience we designed, the more users were able to see how their money was being used to support the specific needs of others in the community, the more positive they felt about the product.

Finding

Participants saw value in helping others, even if they weren’t going to use the coverage themselves. Helping others made our participants feel good, and that provided value in and of itself.

"It’s the fact that you can see the number of people you’ve helped… That helps with the difference between the money you’ve put in and what you needed covered throughout the year. Just knowing that you’ve been helping that number of members makes it more worth the money.”

Arnav S., Cake & Arrow Research Participant

Sharing with others combats digital fatigue and makes Millennials feel more connected.

While intended to combat loneliness, our research found that digital connectedness makes Millennials feel isolated and alone, oftentimes trivializing their connections to other people. Having a community with shared values that depends on you in a tangible way, and one that you depend on in return, tethers you to the real world and makes you feel like you matter.

Finding

Knowing they were making a material impact on their community helped participants feel more connected and less self-absorbed and gave participants a sense of solidarity with the community members.

“This is interesting because it’s not all about you. It’s good because it lets me help others even when I don’t need to help myself.”