source: Brian Zak/NY Post

It was June of 2023 and I had recently returned to work after parental leave. In an effort to reacclimate myself to the realities of work after a few foggy, unmoored months spent caring for a newborn, I was attending the Insurtech Insights conference at Javits Center in Manhattan.

The first day of the conference felt familiar and predictable. Attending panels in the dark, cavernous halls of Javits Center and connecting with old coworkers and connections over catered coffee, I felt a little bit like my old self. But on the second morning of the conference I, along with many New Yorkers, awoke to a scratchy throat and an unprecedented view out my bedroom window. The late-spring sun, filtered by hazy, smoke-filled skies, cast an unsettling, orange, apocalyptic glow over the streets of my Brooklyn neighborhood, ushering me back into another kind of twilight zone.

As it turns out, wildfire smoke had made its way to New York City from Canada causing the city’s worst air pollution on record. In my 15 years living in New York City I had never seen anything like it; neither had my husband, a native New Yorker. Having grown up on the West Coast, I have experienced wildfire smoke many times before, but it was never something I expected to see here. Naively, perhaps, I didn’t think it was possible.

As I masked up and made my way to the conference for day 2—the irony that I was now donning a mask outdoors instead of indoors was not lost on me—the strangeness of the day set in. Attendees packed away in windowless conference rooms typed things on their laptops and snapped photos as the AI-stacked agenda (conspicuously lacking in climate-related sessions) droned on, feeling eerily incongruous with what was happening outside and lending to the day’s sense of disquiet.

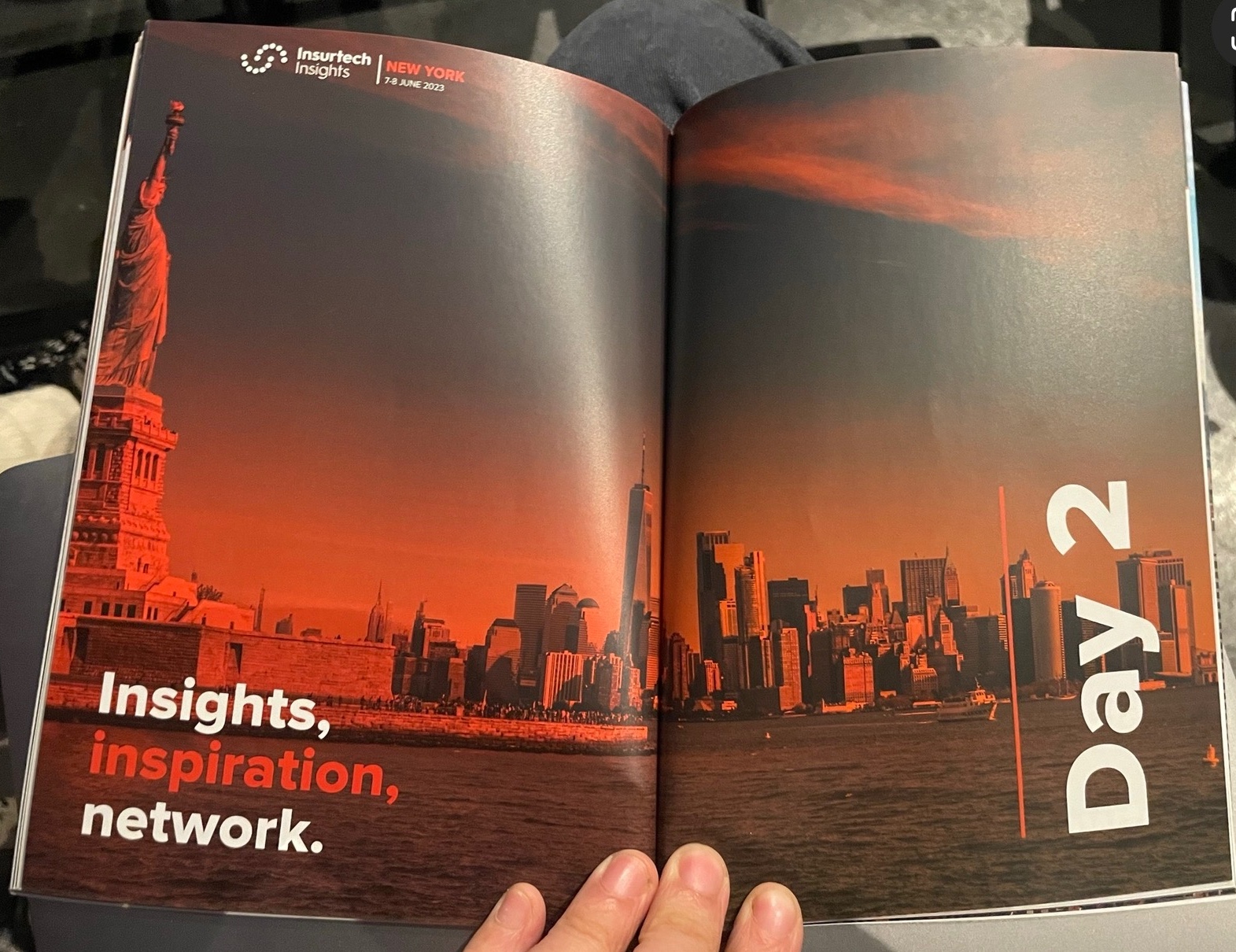

The conference booklet, featuring an image with an uncanny resemblance to what the New York City skyline looked like at that very moment

Moments of realization

I tell this story because, looking back, it represents a bifurcation of time for me; a clear division between a before and an after. This was the day that the weather, with all of its expected variations and shifting patterns, stopped feeling like a generally predictable thing. It’s a feeling that has persisted ever since, through the hottest summer ever recorded on earth and into the fall, where here in New York we saw 8 straight weekends of rain and surprise flash flooding in what is traditionally our sunniest most temperate season.

You may have had your own moment of realization recently—in your personal life, or as someone trying to navigate what this means for your business, especially if your business is insurance.

We at Cake & Arrow have been noting these moments of realization–hearing from our friends and colleagues about freak weather events, and from our clients about the challenges the insurance industry is facing—and are currently in the process of diving deeper into the topic in the way we know best — through research, conducting qualitative interviews with homeowners about climate change and insurance.

As we’ve embarked upon this research, we’ve realized we aren’t alone. A lot of people have recently experienced moments of realization. For some, it was seeing the town they grew up in, a place that had only ever known hurricanes, be ravaged by a tornado. For others, it was going a whole winter in the northeast without a single snowfall. For many, what used to seem like random weather quirks are beginning to feel more like dark patterns, creating a pervasive feeling of unease.

Along with this feeling of unease comes a sense of uncertainty. Uncertainty around the weather, of course, but also around the impact changing weather may or may not have on one’s life. What does it mean for our future, for our families, for our jobs, for our homes?

When it comes to our homes, the impact may be more significant than a lot of people realize. According to a recent report by the nonprofit research firm First Street Foundation, 39 million properties—or a quarter of all homes in the United States—have been underpriced for climate risk, a phenomenon they have coined the “insurance bubble.” In coming years, these homeowners may see premium percentage increases in the triple digits, lose their insurance altogether, and/or see the value of their homes plummet. The same report found that “the average homeowner who loses an insurance policy automatically sees a drop of more than 10 percent in the home’s value.”

How are homeowners feeling the impact of climate change? In big and small ways.

Most people we have spoken with so far have already been impacted by climate change in some way—rising premiums, surprise weather damage, etc. But only the unlucky few who have lost homes or suffered significant damage have any tangible sense of what the changing weather might mean for the value of their homes—and they certainly aren’t expecting their insurance companies to help them figure this out. While some have remained blissfully unaware of what it all means for their future as homeowners, others are immobilized by anxiety, unsure of how to best protect their families, their homes, and their investments

While we are still in the middle of gathering stories and synthesizing what we are learning, we thought it would be interesting to share an in-progress snapshot of what we are hearing and learning as we speak with homeowners. Based on these conversations—with people from all walks of life and from around the country—this is a window into how they are experiencing the impacts of climate change and thinking about it in relation to insurance and their homes.

Homeowner perspectives

1. Savvy and proactive

“I realized that the disparity between what coverage I could get and what my home was worth made owning a home in Miami incredibly risky, which is in large part why we moved to Rhode Island.” – Rob, homeowner who recently relocated from Florida to Rhode Island

Some of the more savvy and experienced homeowners, like Rob, saw the writing on the wall when it comes to the risks related to climate and insurance, and are actively making decisions to protect their investments.

2. Blindsided and traumatized

“My home wasn’t in a flood zone. This wasn’t supposed to happen.” – Dan, homeowner who lost his Long Island home during Hurricane Sandy

Some people we spoke with were under the impression that because they were not in a flood zone or a fire zone, they didn’t have much to worry about. Changing weather patterns are fast redrawing these lines, even while zoning hasn’t caught up yet. Dan, a lifelong Long Island resident was forced to rebuild his home after Hurricane Sandy when an unprecedented storm surge left his home completely flooded, despite not being in a flood zone.

3. Abandoned and disillusioned

“If homeowners insurance wasn’t mandated by my lender, I’d probably just buy insurance for theft and not for the house itself. Because frankly, they’re not helping me in any way right now. They didn’t cover the hail damage to my roof or the damage to the inside of my house that was caused by the roof leaking. So what do they cover then? Like seriously, what am I paying for?” – Jeff, Texas homeowner whose roof was damaged by a freak hail storm

In places like Texas, where erratic weather has caused massive and widespread damage to homes, insurance fraud is rampant, making it hard for people like Jeff to get a legitimate claim covered, ultimately disillusioning him about the value of insurance.

4. Reluctantly self-reliant

“In a way, you are kind of left to do the analysis yourself to make sure you are buying in a safe area. And these days, even if you aren’t in a flood zone, you really don’t know. Part of the reason we bought in the neighborhood we already lived in is because we felt like we knew what to expect.” – Samantha, homeowner and lifelong Orlando resident

Homeowners like Samantha, who have spent their entire lives in the same place, are often most attuned to the changing weather. With few resources to turn to, they are relying on their own observations and knowledge of the weather to make decisions about their safety and investments.

5. Prudent but still susceptible

“When I bought our house, we specifically bought here because of the milder climate. It seemed safer. But since we’ve lived here every summer, there’s been a really bad wildfire–which used to be rare. It definitely wasn’t something I was thinking about when we bought this house or when I was researching insurance policies.” – Ethan, homeowner in Olympia, WA who grew up in Chicago

We spoke with several homeowners who went out of their way to buy homes in a specific area to avoid a specific threat, only to be blindsided by another climate threat altogether. In Ethan’s case, he bought a home inland in Washington State, consciously avoiding coastal areas and extreme temperatures but is now worried about wildfires.

6. Inconvenienced and uneasy

“One of the major hurdles to buying my house was the insurance aspect—not because it was difficult to get coverage, but because I couldn’t go directly to my insurance company. They had recently pulled out of California because of the climate risk, so they basically just acted as a middleman between me and the actual provider. The wait times on the phone were a nightmare and several things needed to be fixed on the policy. The insurance was the reason the close date on our home was delayed. It makes me very worried about what things will be like if I ever have a claim.” – Travis, a recent home buyer in Riverside, CA

Even people who haven’t lost their insurance or seen their premiums skyrocket are experiencing the indirect impacts of climate change on insurance. In states like California and Colorado, where insurance companies are leaving due to climate risk, some homeowners are suffering from worsening customer experiences, diminishing the value and perception of their insurance policies.

___

These stories are our stories. While they may only be a handful of perspectives from a few people across the country, they are indicative of larger trends, and incapsulate the attitudes and feelings of many of us. Ultimately, when it comes to climate change few of us will escape impact of some kind. And for an industry like insurance, this forces questions around what a value proposition for the industry might like, and how risk mitigation will work in a world that is far riskier for everyone.

Stay tuned as we continue to explore the impact of climate change on homeowners and the insurance industry at large through our research findings.