While it may be true that no one will ever really like buying insurance, there are definitely ways to make the experience less painful. And in recent years, the industry has been exploring how to do this, from launching direct-to-consumer digital experiences, using data and automation to streamline the quoting and application process, and exploring new technologies like IoT and machine learning to reimagine the way that people interact with and buy insurance. Meanwhile chatbots–smart digital tools that can do things like conduct conversations, answer questions, and help people complete tasks–have been used in the industry for years, but have yet to reach their full potential. Chatbot technology holds great promise for insurance carriers and consumers, and, if used well, can fundamentally transform the process of purchasing insurance into the seamless, intuitive, and painless experience consumers are craving.

Over the past several years, as more and more insurance companies have begun selling insurance direct via digital channels, they have encountered both enthusiasm and resistance from consumers, many of whom report that while they may like the convenience of purchasing insurance online, they don’t necessarily trust insurance carriers, and still rely upon the expertise of agents to help them choose the right kind of coverage, get the best price, and navigate the often tedious application process. The more innovative insurance carriers (and now insurtech startups) have attempted to tackle this issue, the most successful being those who have turned to best-in-class UX research and design to help them build more trustworthy digital experiences that educate consumers, streamline the application process, and provide opportunities for easy customization.

Although user experiences in insurance continue to improve, they are still nowhere near being leading edge, and are still limited by a fundamental constraint of traditional UI design: data input. For years, UX and UI designers working in industry after industry have struggled to find the balance between gathering the information needed from consumers to provide accurate quoting, pricing, billing, delivery etc. while not exasperating them in the process. And still the best insurance quoting experience is the one with the simplest form.

But what if users didn’t have to fill out forms at all?

One of the reasons consumers like working with agents is because the buying process is conversational. Answering questions is not only easier than filling out a form, but being responded to in real time is more engaging for consumers and limits the sense that they are simply inputting information into the ether. Instead, what they say is heard, considered, sometimes clarified, and used in the service of getting the right coverage at the right price.

With the right chatbot technology in place, consumers can kiss forms goodbye. With chatbots, buying insurance can be both convenient and conversational–providing consumers the autonomy and flexibility of purchasing insurance online, while also offering the same kind of expertise and responsiveness they might get by going through an agent.

So what qualities would such a chatbot possess?

The qualities you’d want in a chatbot aren’t that different from what you might look for in a agent or a call-center representative. In fact, chatbots, agents, and customers are already working together––learning from an assisting one another. Liberty Mutual Insurance’s “skills” for Alexa and Geico’s “Kate”, for example, can both answer customer questions and give advice, but neither have graduated to actually helping users purchase insurance. Still, there is much these bots can learn from agents (and vice versa) in the meantime about what it takes to service a customer.

Like a good agent, a good insurance chatbot would:

1. Be friendly and conversational

For the chatbot experience to work, it must feel natural, as if there is really another person on the other side of the screen ready and willing to help. There are a few simple things you can do to make your chatbot more accessible:

- Give your chatbot a name, and even a photo. Such niceties can go a long way in establishing a more human-like identity, and can set a friendly tone before anything is typed or said.

- Ensure your chatbot employs natural, friendly language, using phrases like “Hey there!” “How’s it going?” “Give me a sec” or “Awesome!” Consider employing a talented copy writer or script writer to help develop a database of friendly phrases and language, including use cases with how words and phrases can be used effectively.

- Ensure your chatbot is responsive to everything typed or said by a user. If a user types hi, your chatbot should greet the user. If a user types sorry, your chatbot should tell them “No worries!” Being responsive to both important, mundane and even silly questions and phrases will make your chatbot seem human and approachable.

2. Be helpful

Consider how many times you have spent time filling out a form only to submit and find there is an error, but you don’t know what it is. This is the kind of experience that makes people abandon shopping carts or quit an application halfway through. A helpful chatbot can ensure this never happens again. A helpful chatbot will do things like:

- Clarify information. Say a user types that they live in Portland. Your chatbot should ask whether they mean Portland, Maine, or Portland, Oregon. A chatbot who asks the right questions, at the right time will gain the trust of the user and will help them avoid potential issues later on in the process.

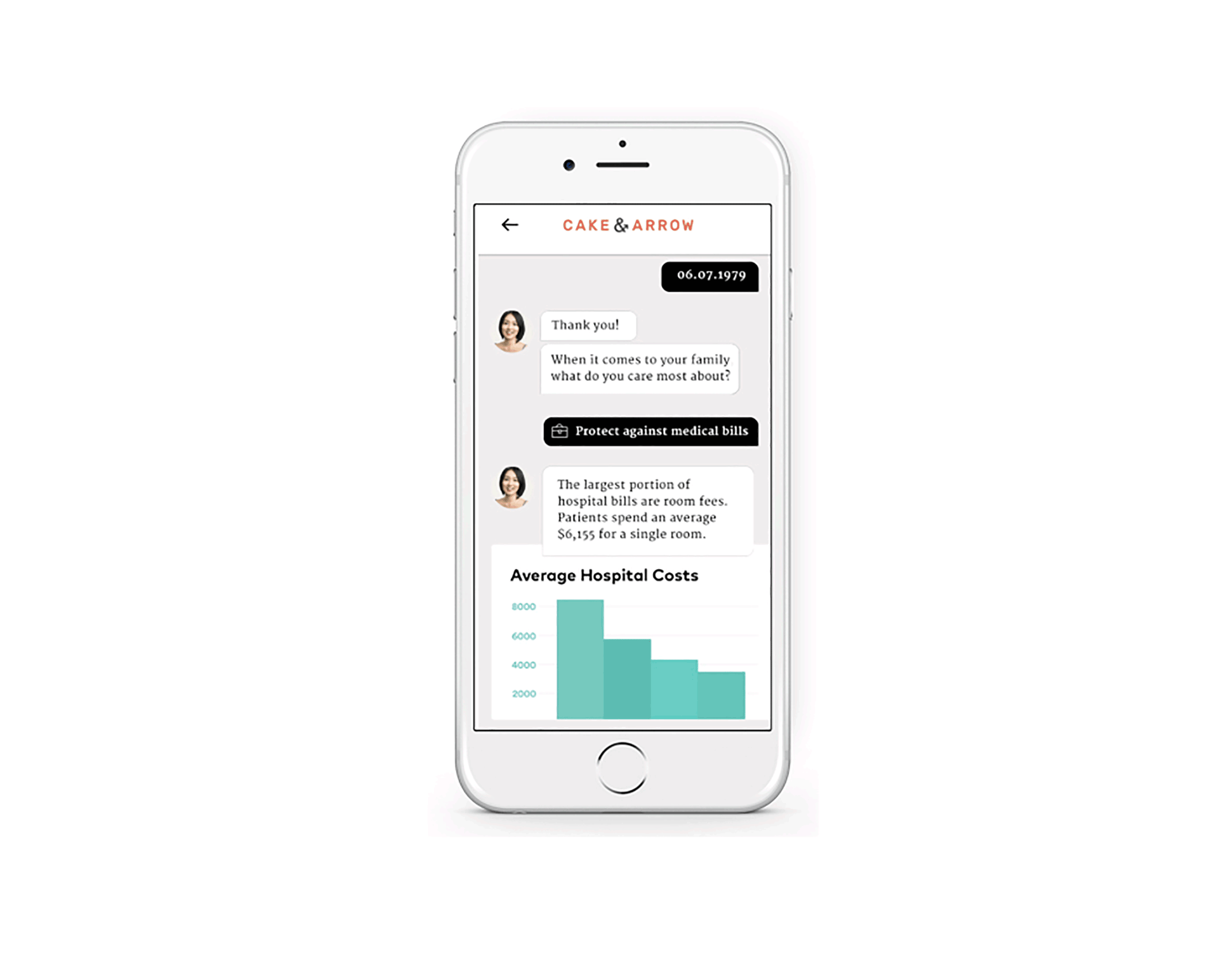

- Anticipate needs and questions. Chatbots can also provide helpful insights throughout the quoting and buying process, such as interesting industry trends or data points that can help users make more informed decisions about insurance. A good chatbot will answer questions before they are even asked, further alleviating the burden on users.

- Ensure your chatbot employs natural, friendly language, using phrases like “Hey there!” “How’s it going?” “Give me a sec” or “Awesome!” Consider employing a talented copy writer or script writer to help develop a database of friendly phrases and language, including use cases with how words and phrases can be used effectively.

- Ensure your chatbot is responsive to everything typed or said by a user. If a user types hi, your chatbot should greet the user. If a user types sorry, your chatbot should tell them “No worries!” Being responsive to both important, mundane and even silly questions and phrases will make your chatbot seem human and approachable.

- Make suggestions. Customers like working with agents because they will offer suggestions on things like how to save money on a policy or get better coverage at a better price. Chatbots should do the same, offering up helpful suggestions as they arise.

3. Be easy to work with

Using a chatbot should be easier than buying insurance independently online and than going through an agent. It’s important that chatbots reduce the burden on the user as much as possible. Here are a few things to consider:

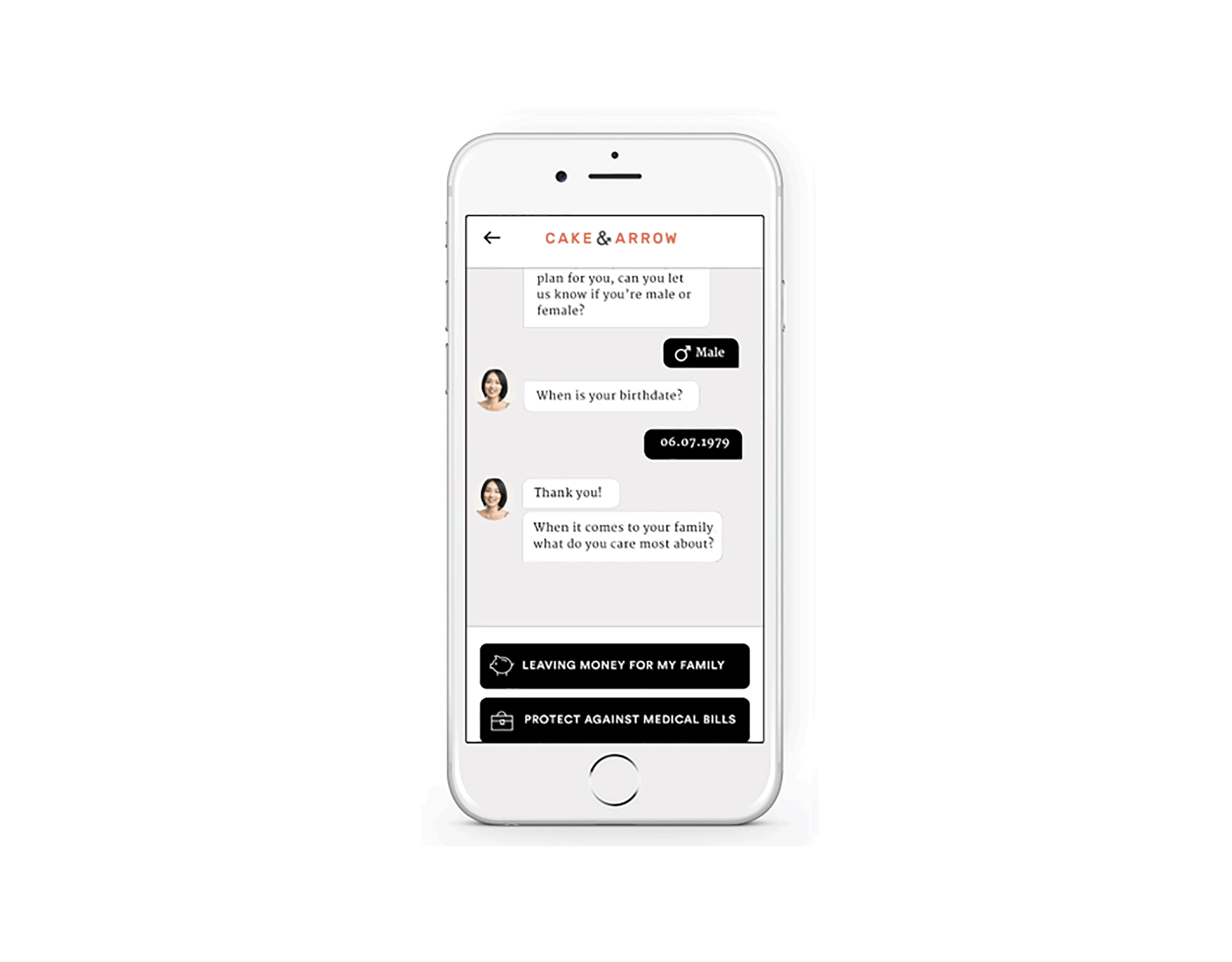

- Whenever possible, give users the option to tap on buttons rather than type in responses. For example, asking whether a user is married or about their gender? Don’t make them type–simply ask them tap on their response.

Using a chatbot should be easier than buying insurance independently online and than going through an agent. It’s important that chatbots reduce the burden on the user as much as possible. Here are a few things to consider:

- Whenever possible, ask users to validate information rather than type it in. In the same way that the simplest form is the best form, limiting the number of questions a chatbot asks a user to answer will improve the experience. For any data that can be easily pulled or obtained from somewhere else, don’t ask users to give you this information, ask them to validate it.

- This should go without saying, but your chatbot should be available 24/7. The convenience factor is the number one reason people are interested in purchasing insurance direct.

4. Be intelligent

Chatbots should know what they are talking about. They should be able to answer almost any question pertaining to the insurance being sold, easily validate important data, offer up advice and suggestions, and know the nuances of products and how to save people money. In short, they should be able to bring the same expertise to the table as an agent. When making your chatbot smart, consider using machine learning to:

- Designate “specialists”. As chatbots gain experience helping users buy insurance, like real employees, they may start to specialize. One chatbot may have more experience with cancer and another annuities. Assign the right “expert” based upon the user’s needs.

- Curate coverage options. The more customers your chatbots work with, the more knowledge they will have about the right coverages for the right needs and risks. Your chatbots should not only be able to curate coverage options that offer each unique user the right levels and types of coverage, but should be able to help users customize coverages so that they meet both their budgets and their needs.

Using a chatbot should be easier than buying insurance independently online and than going through an agent. It’s important that chatbots reduce the burden on the user as much as possible. Here are a few things to consider:

- Reduce errors. As they gain experience with customers, your chatbot should be able to do things like catch spelling mistakes or common typos to ensure little things don’t hold up the quoting and application process.

5. Be adaptable

Like human beings, chatbots should be adaptable to different environments and situations, and should learn and improve based upon user feedback. An adaptable chatbot:

- Can detect a user’s device and environment, and accommodate both voice interactions and typing, and easily be able to switch between these as needed.

- Can speak different languages, and accommodate users based upon their language preference.

- Is subject to user feedback. Like a rideshare driver or call-center representative, a chatbot should be reviewed by users, and improve their performance based upon feedback.

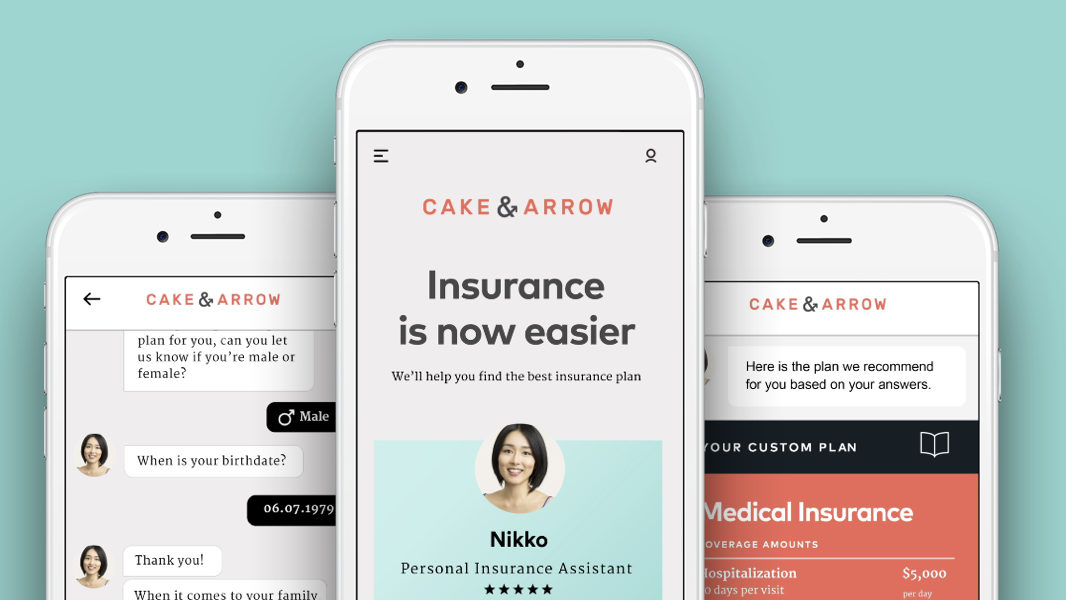

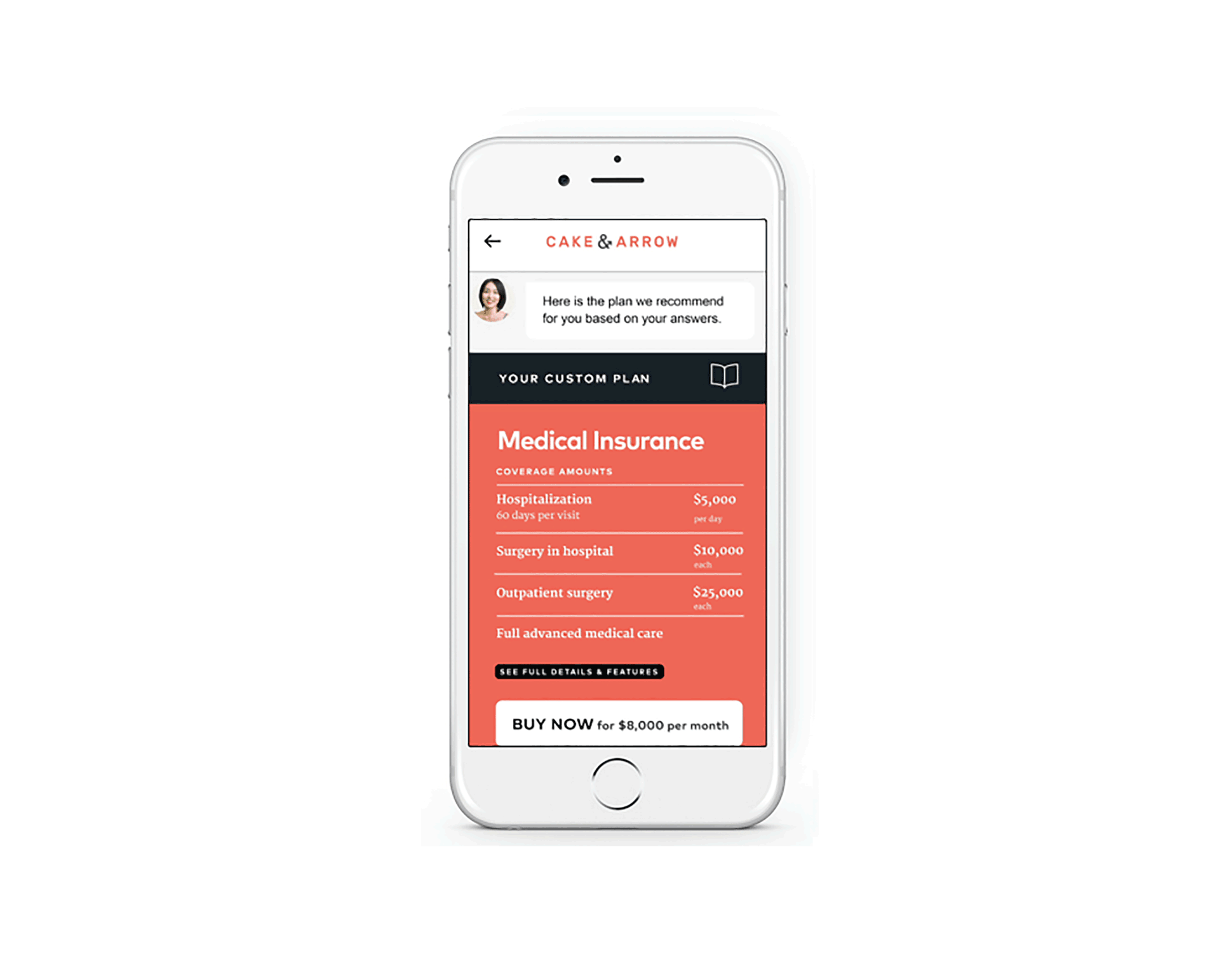

So what would it look like if a chatbot could help you buy insurance? It would look like this.

In the digital experiences of the future, conversational interfaces with tappable buttons will replace forms, making any kind of application process seamless and intuitive. In this video we explore what buy insurance would be like with the help of a chatbot.

Playing a dual role as on-demand advisors and smart digital assistants that are at once efficient, intelligent, task-oriented and friendly, chatbots embody the future of buying insurance. And the future is not far away. In fact, the future is here. The technology for such a chatbot is available now (and already being used in other industries). Until online experiences begin to feel as personal, as conversational, and as trustworthy as working with an agent, they will continue to be met with skepticism. The future is here. It’s time the insurance industry takes hold.