As consumers, we’ve all been forced to navigate the websites or apps of recently combined companies. We’ve puzzled over mixed branding and messaging, cursed our way through multiple logins, and lost patience jumping from platform to platform. By the time we’re in a place to click “buy now,” we’ve moved on to work with a more customer-friendly company.

As mergers and acquisitions (M&A) transform the insurance landscape, tangled experiences like these will continue to confound customers and eventually, negatively impact business.

A quick Google search reveals the many M&As executed across the insurance industry over the past decade. These strategic moves have helped carriers diversify with new products, geographies, and distribution channels, and expand tech and talent through insurtech acquisitions. Brokers have built leverage, increased access, and created efficiencies of scale. The list goes on…

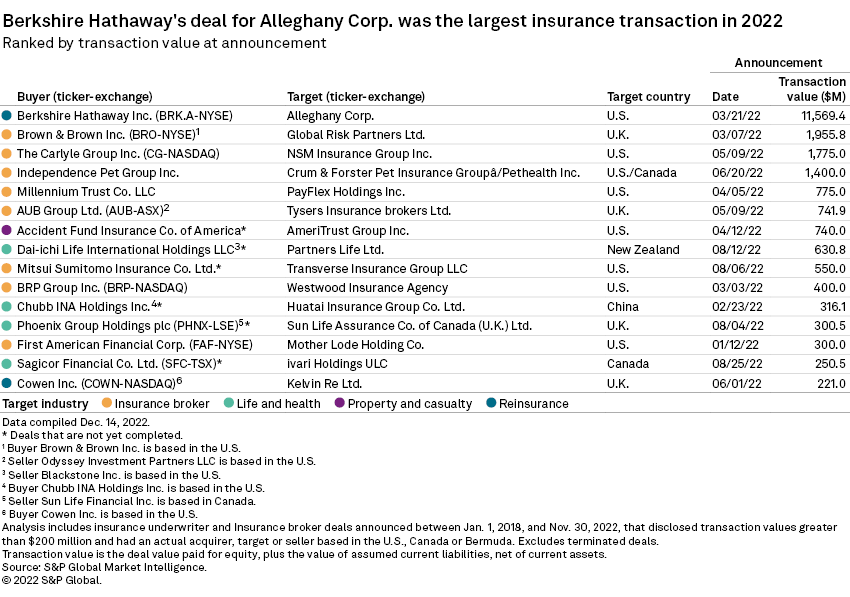

S&P Global Market Intelligence: 15 Largest insurance deals of 2022

If executed effectively, a merger or acquisition can yield big wins for everyone engaged in purchasing insurance. Carriers, brokers, independent agents, and end consumers can all benefit. But that’s a big “if.” Too often, overlap and divergence between the company’s respective experiences undermine potential synergies.

At Cake & Arrow — a CX design agency working within the insurance industry — we’re often tapped to help untangle digital experiences that get snarled when companies tie their fortunes together.

To untie these knots, we wind back to the basics. We start with people, not technical solutions, and take a holistic look at the new, combined customer base. Then we consider how these customers might benefit from doing business with this newly formed entity. We observe as old and new users navigate touchpoints and systems, and we speak directly with people about their experiences and expectations.

With this research as a foundation, we work through the specific CX changes required to meet the needs of these customers. Then we develop a vision for an experience that leverages the advantages of the newly unified organization.

Protecting and evolving CX through M&A

Our experience has shown that all the backend consolidation, access, and options in the world won’t mean a thing if customers feel pain working with companies united in name only. To avoid this outcome, wherever you are in the M&A process, pay attention to these four key considerations:

1. Consider how your old and your new customers compare

You’ve just agreed to a merger or acquisition with another business… that’s great. Your due diligence has probably covered loss experience, risk exposure, concentration, and other business metrics. But how much work has gone into really understanding the new business’ core customers?

- Who are they; what do they expect?

- What do they think of their current user experience?

- Will your current experiences enhance or detract from their satisfaction?

- Will your messaging and digital content resonate the same way?

- Does your digital strategy make sense for your new customers?

Assuming some level of focus and differentiation in your existing strategy, you need to be hyper-aware of any adjustments your new customers may require. The only interest they’ll have in your existing operation is whether or not it meets their needs. Find out sooner than later if you’ve introduced an experience that is better, worse, more complex, or less intuitive.

2. Ask if change is even necessary

Before moving your newly acquired customers to your current experience, or vice versa, you must understand their expectations. Getting to know them is a good start. However, it’s time to really understand which elements are better or worse within the multiple experiences you now own and need to support.

Big changes to underlying technology can cost millions. But migrating systems, data, and setting up backend architecture and integrations could be an unnecessary spend. Often, a much smaller investment in UX research will reveal that technical shifts can be more iterative — or sometimes not necessary at all. Focus on the moves necessary to grow and retain customers. Weigh them against the potential loss of customers through a poorly executed and possibly unnecessary change.

Over time, you’ll likely find that neither experience is a perfect fit for everyone. Do the work to learn where the mismatches are, and how far they go. In an industry built on managing risk, it’s safest to avoid assumptions and make a minor investment early to verify what, if anything, needs to change.

To manage change efficiently, try parallel work streams. Following M&A, there’s often an early focus on reducing duplication, increasing efficiency, and upgrading outdated tech and processes. While this essential operational reconciliation is happening, run a parallel track of work to determine what should change on the customer-facing front. Reap operational rewards while setting yourself up to address any gaps and needed changes in your user experience.

3. Focus on why you merged to help determine where to start

Presumably, there is an underlying thesis on how the M&A will benefit customers and the company through growth and retention. Thoughtful, intentional partnerships that provide better products and more value to customers are obviously a good thing.

The key is to stay customer focused. Somewhere in the process of teaming up, someone likely uttered the words, “it just makes sense.” Lean into that. Whether the idea was to offer more products or services, expand capabilities, increase stability, or something else—don’t lose sight of it once the deal is done.

CX considerations for specific M&A motivations:

- Creating synergy? Design an experience that maximizes the strengths of each organization — consolidate systems and operations were it counts.

- Eliminating competition? Don’t also inadvertently eliminate any differentiating CX bright spots, highlight and expand on them!

- Supporting growth and expansion? Analyze and leverage user data understand and market to new audiences.

- Diversifying your offering? Make sure your experience capitalizes on cross-sell and upsell opportunities.

As teams and organizations band together, more people will join the mix. With this comes many good ideas (and some bad ones) about how each little world or department can benefit from the union. Success depends on ensuring that all steps taken serve to benefit the customer, and not just a team or line of business. These goals aren’t necessarily mutually exclusive, but they can be unintentionally at odds.

4. Question whether starting from scratch is better than combining UX or transferring customers

It’s easy to assume that defining the customer experience after M&A will be a simple choice between using “theirs” or “yours.” Depending on the M&A motive, the best answer might actually be “neither.”

For example, if you baked an awesome cake, and the new company baked an awesome cake, but taste tests confirm that your cake layers are better and their frosting is better, you wouldn’t just take the frosting off their cake and put it on yours.

The time and effort would be too high, it wouldn’t taste as good as if you planned the flavors and textures from scratch, and you’ll probably make a big, sticky mess. When you have two great recipes, thoughtfully reconciling them into one new, improved product will result in a much tastier outcome than just smashing them together.

Still, you might be fairly thinking, “but we just baked our cake,” or “baking a new cake requires more ingredients.” It comes down to whether you’d rather launch a subpar version of your product, or show the world what’s possible when M&A is executed right, and in service of the customer.

The unified path forward

The CX roadmap gets much more clear after this foundational work is done. Companies can focus on the right initiatives, invest wisely, and bear the fruits of their M&A activities much more quickly. In the end, the ROI is greater due to reduced unnecessary spending, increased speed to market, employee retention, and customer value.

People make the difference in whether M&A is successful or not. Keep your focus on customers and make operations, IT, and user experience decisions to serve them. This will reduce risk and increase the likelihood of manifesting the initial vision for joining forces.