Over the last several months, we have been talking to homeowners impacted by the climate crisis. By engaging homeowners from across the country in 1:1 qualitative interviews, we sought to understand better how homeowners perceive risks related to climate change, what they are doing to protect themselves, and what role they expect insurance to play.

The goal of this research wasn’t to solve climate change or even attempt to offer a solution to the enormous climate crisis facing the insurance industry today, but instead to recenter the humans at the heart of the climate crisis and to remind an industry often hyper-focused on mitigating its own risk of its ultimate purpose– to act as society’s safety net.

Throughout these conversations with homeowners, we learned lots of interesting new things.

For instance, we learned that homeowners are eager for more data, information, and insight into the risks they face and what they can do to mitigate these risks better—yet most don’t know where to find the information they are seeking.

We also discovered that, despite concerns about climate risk and uncertainty around how their insurance companies might respond to climate-related damage to their homes, homeowners are steadfastly optimistic about the security of their real estate investments.

Moreover, it became evident that people’s connections to their homes, communities, and the concept of “home” vary widely, influencing attitudes toward risk, insurance, and finances. Factors such as education, income, life stage, and attachment to a place all shape individuals’ perspectives on climate change and homeownership.

From climate crisis to claims

Interestingly, some of our most compelling and actionable findings weren’t directly connected to the climate crisis at all but were related to the claims process.

The overwhelming majority of homeowners we spoke to who had been impacted by climate change and recently filed claims with their insurance companies recounted negative experiences.

These narratives often involved prolonged battles with insurers, characterized by elusive adjusters, misplaced records, unreturned phone calls, and a prevailing disillusionment with the industry. Even those with more positive encounters experienced notable anxiety around the claims process. They were frustrated by the lack of transparency and communication and unduly burdened by administrative tasks required to resolve their claim.

While these problems did not originate with the climate crisis, they may be felt more deeply as anxiety around climate change proliferates and claims become more common and (or) more severe. Finding ways to improve the claims process is not only a way of supporting customers impacted by climate change but of building trust with customers everywhere—whether climate change comes for their homes or not.

As Tanner Sheehan, vice president and general manager, U.S. Claims at LexisNexis recently stated, “Insurers who can better align the claims experience to customer expectations are not only delivering the quick and easy interactions customers seek, but they are also better positioning themselves to retain policyholders.”

Reimagining the claims experience for everyone

As we dug into what we heard in our conversations with homeowners about their claims experiences, a few key insights stood out:

- The claims process is tedious and burdensome. Homeowners can feel alone and unsupported, as it if it is on them to get their claim paid — not their insurance company’s.

- Homeowners often file claims in tandem with traumatic experiences. They seek personal and compassionate support to guide them through the claims process.

- Communication around how to complete the claims process and a lack of clarity and transparency about the status of a claim create anxiety for homeowners, adding to the stress of trying to repair damage to their homes.

And so equipped with this knowledge, we asked ourselves? How might we make claims tracking human, transparent, supportive, and easy to follow in real time?

In response to this question, we designed a claims status progress tracker that would make checking on the status of a claim as simple and reassuring as tracking a shipment. By allowing policyholders to track the status of their claims in real-time, much like they might their packages, they’d know down to the hour when their claim would be resolved, eliminating worry and anxiety and building trust in the process and the insurance company.

When we showed this concept to homeowners who recently filed claims, they were enthusiastic. Through these conversations, we learned that:

1. Breaking down the claims process step-by-step relieves anxiety and provides peace of mind

“Anxiety goes down when you see how it is going to progress or how it will unfold step-by-step like this, even if the process is tedious.”

Ayize, 36, Seattle, WA

2. Generic timelines from insurers don’t feel real. Specificity and transparency around how long things take and when they will happen builds confidence in the claims process.

“People on the phone would sometimes give an estimate of when things might happen, but that was not very accurate.”

Bruce, 47, Philadelphia, PA

3. Apps can feel impersonal. People dealing with trauma want to talk to actual people first. They want to use apps to “check in” and see that their claims are progressing but do not want to initiate them via the app.

“I was checking the claims, I was checking everything. At that point, anything I could do I was doing. I would have appreciated anything that would help to relieve the anxiety.”

Jessica, 46, Kearny, NE

4. Supplementing the claims process with real-time notifications updating homeowners on the progress of their claims helps them feel like they are being kept in the loop.

“I'd be happy to get a text message so I don't have to go hunt it down. But I don't want to be bombarded.”

Bruce, 47, Philadelphia, PA

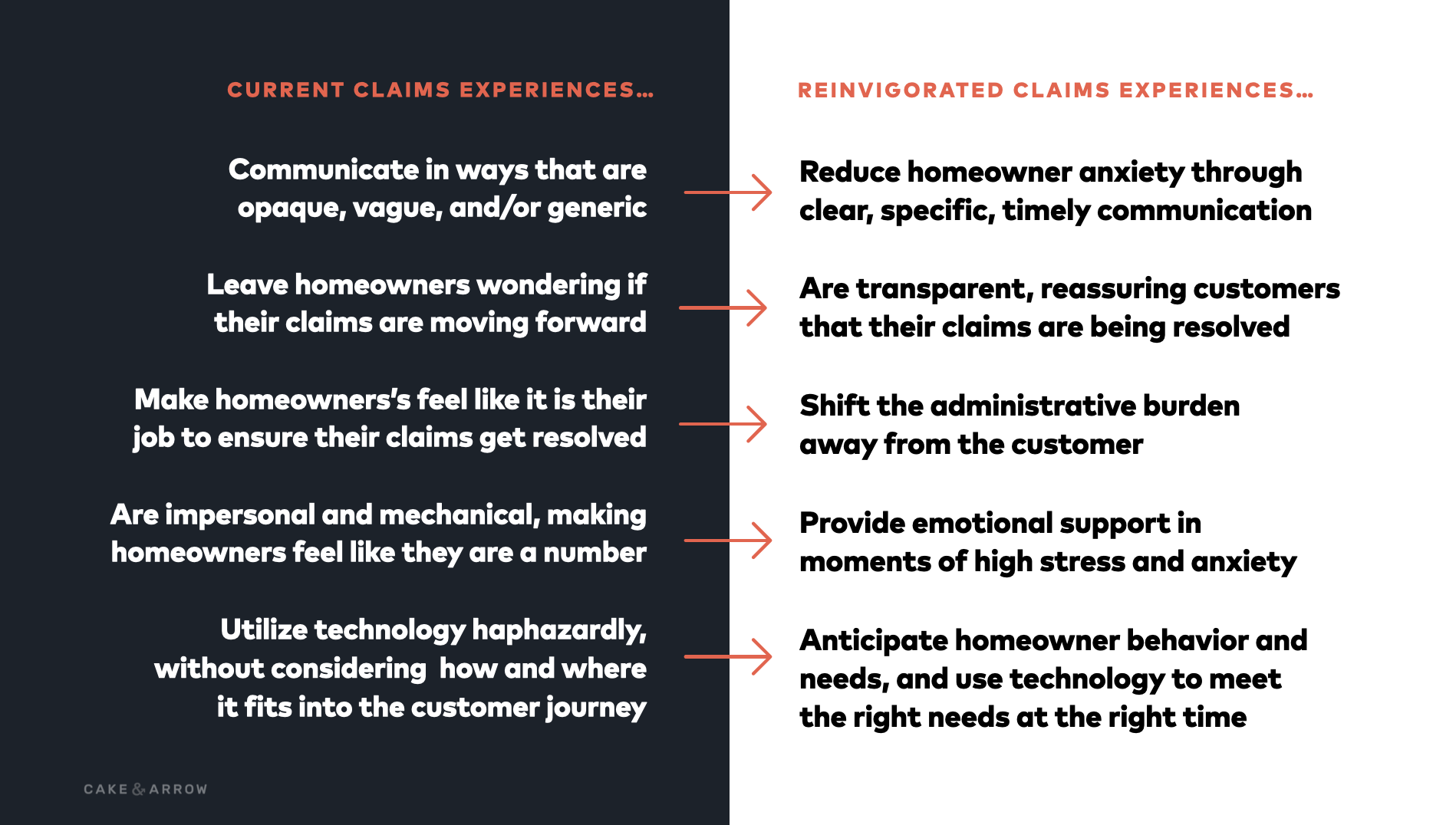

By delving into the experiences of homeowners grappling with climate change and the challenges they face when navigating insurance claims, we uncovered meaningful insights into how the insurance industry can better support not just homeowners impacted by climate change but all policyholders. Ultimately, we learned there are specific ways in which current claims experiences might be reinvigorated to realize a vision of a claims experience that truly works for everyone.