Optimizing and innovating digital experience to increase conversion

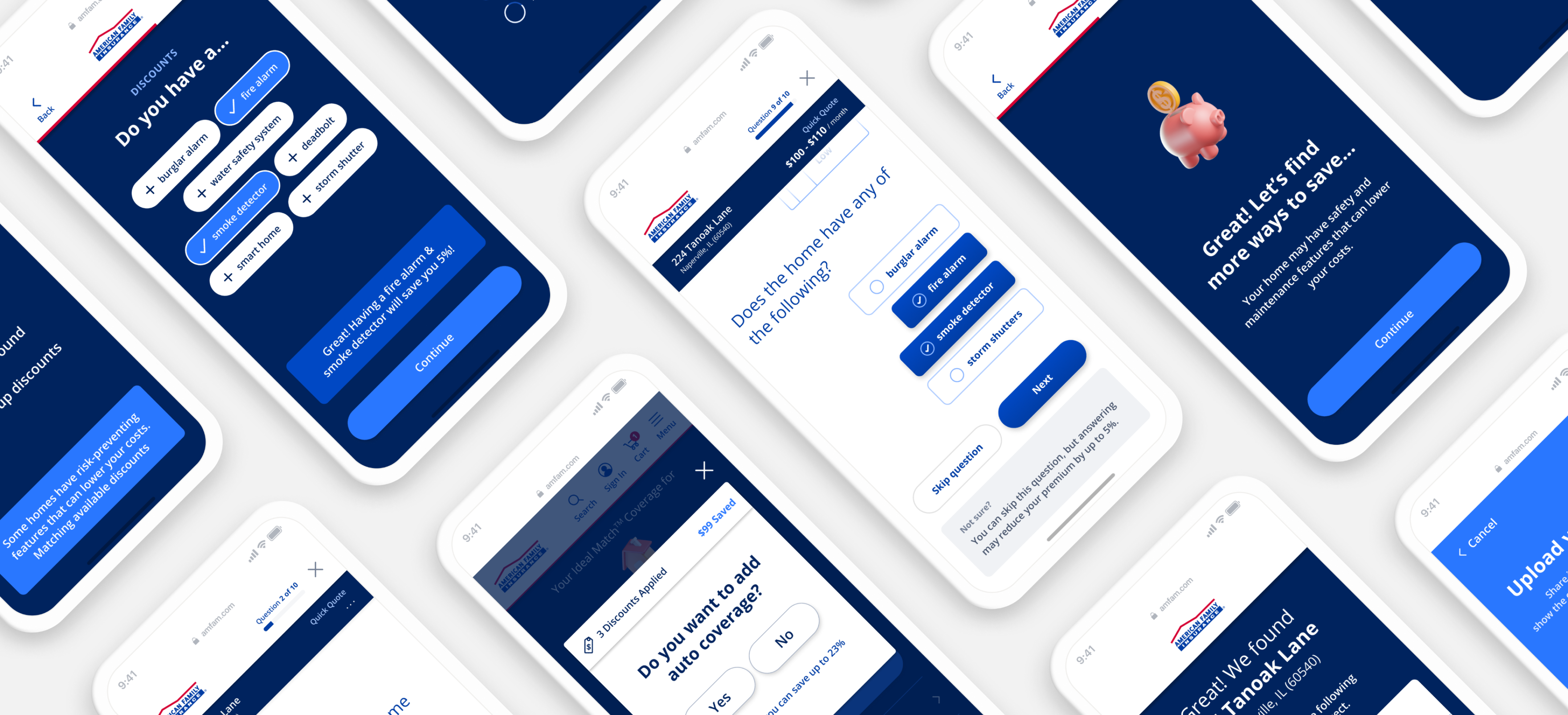

American Family Insurance (AmFam) saw an opportunity to increase conversion for its homeowners offering by improving the website marketing landing pages and self-serve quote flow processes to better align with customer needs and expectations.

The existing content-heavy landing pages were informative, but undifferentiated. They described the products and detailed features, but did not speak directly to the experiences of first-time home buyers or “switchers” looking to change providers. And the interface for site visitors to get quotes was dated and unintuitive, putting unnecessary pressure on consumers to enter information that technology could easily source and pre-fill.

The AmFam team believed that a more targeted approach to these key consumer touch points would yield results, but technical and business constraints meant that UX updates would need to start small and impactful, then build up to bigger changes. They engaged Cake & Arrow to research consumer expectations and needs and then design future state experiences and an actionable roadmap to get there.

Experience Design

Visual Design

User Research

Digital Strategy

Eye-opening user research and targeted design recommendations

Tapping AmFam’s User Insights team and tools for collaboration, Cake & Arrow conducted primary user research to learn first-hand about home buyer and owner behaviors and preferences. This insight-based foundation informed the delivery of production-ready designs for key quote pages and landing pages, as well as forward-looking concepts, and a staged plan to get there.

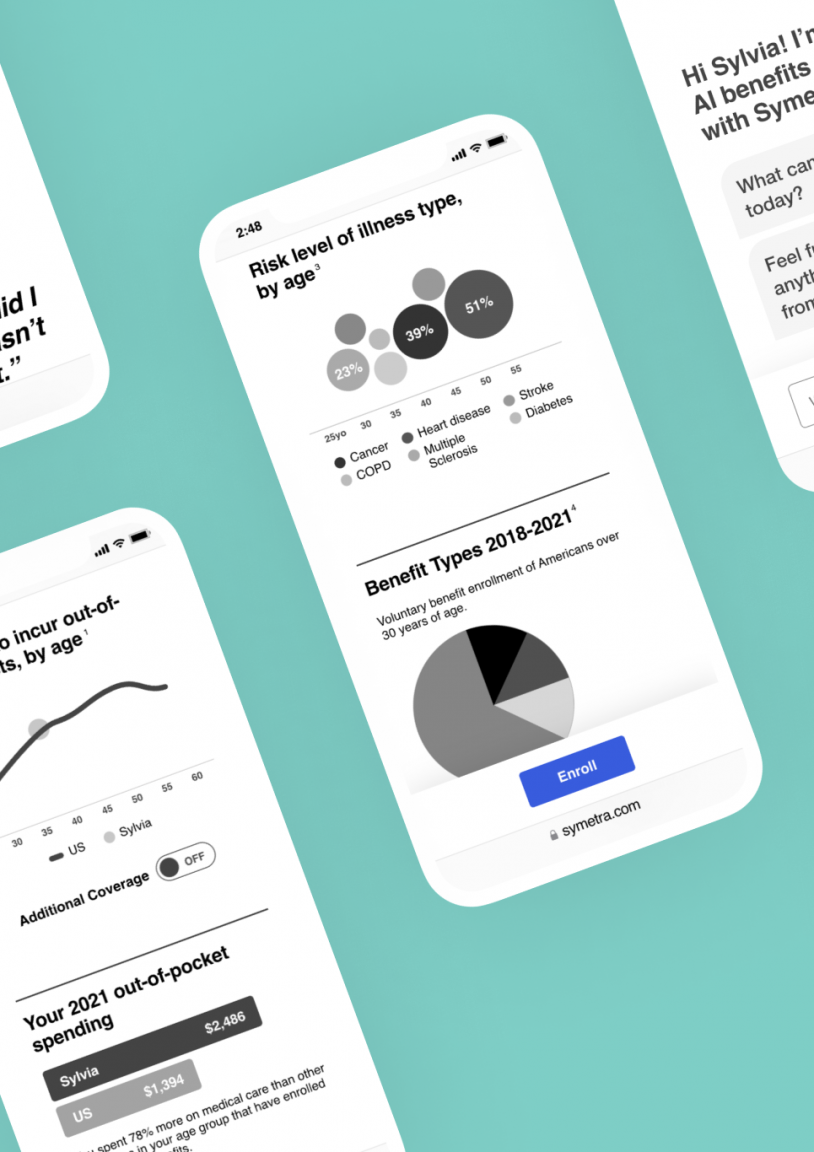

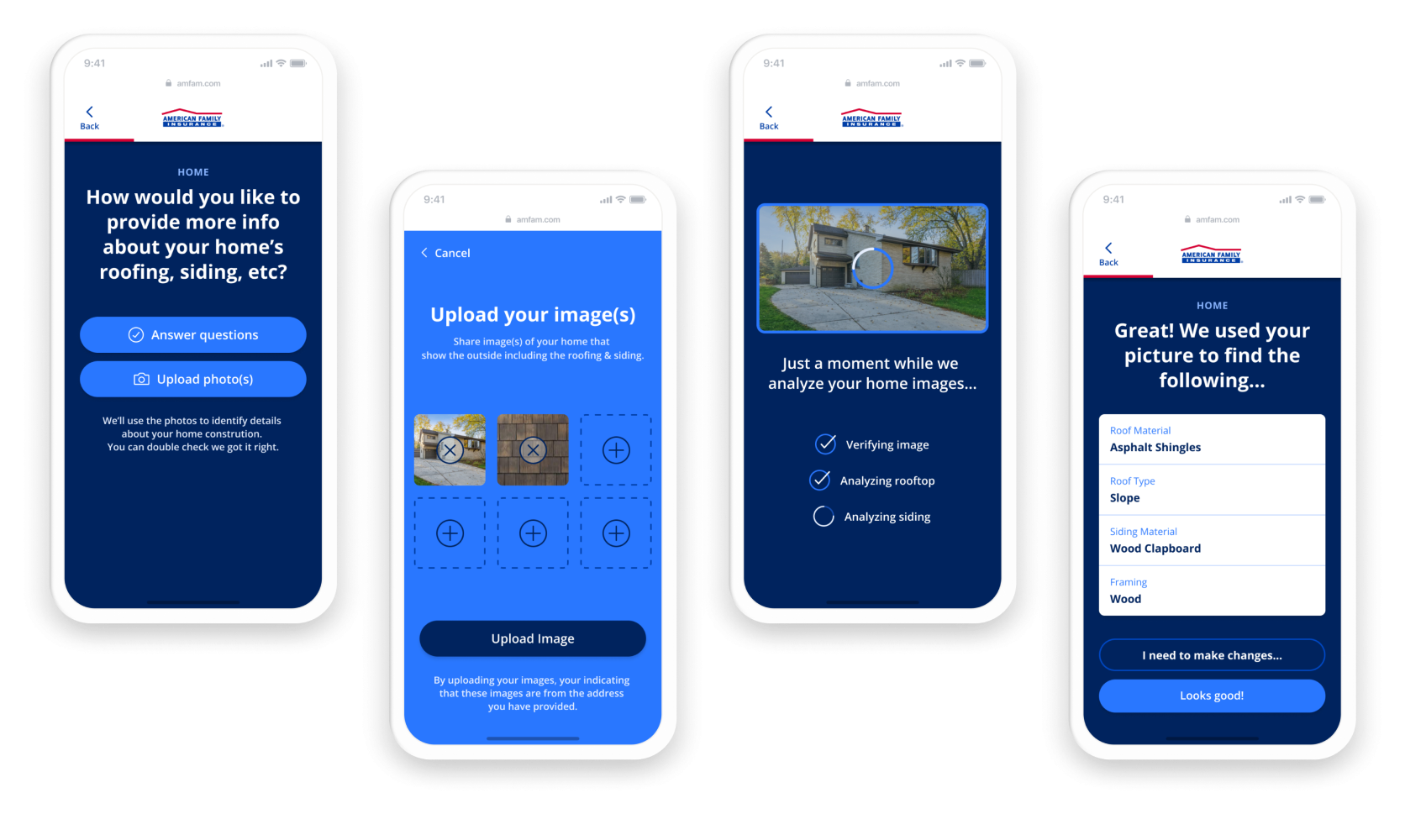

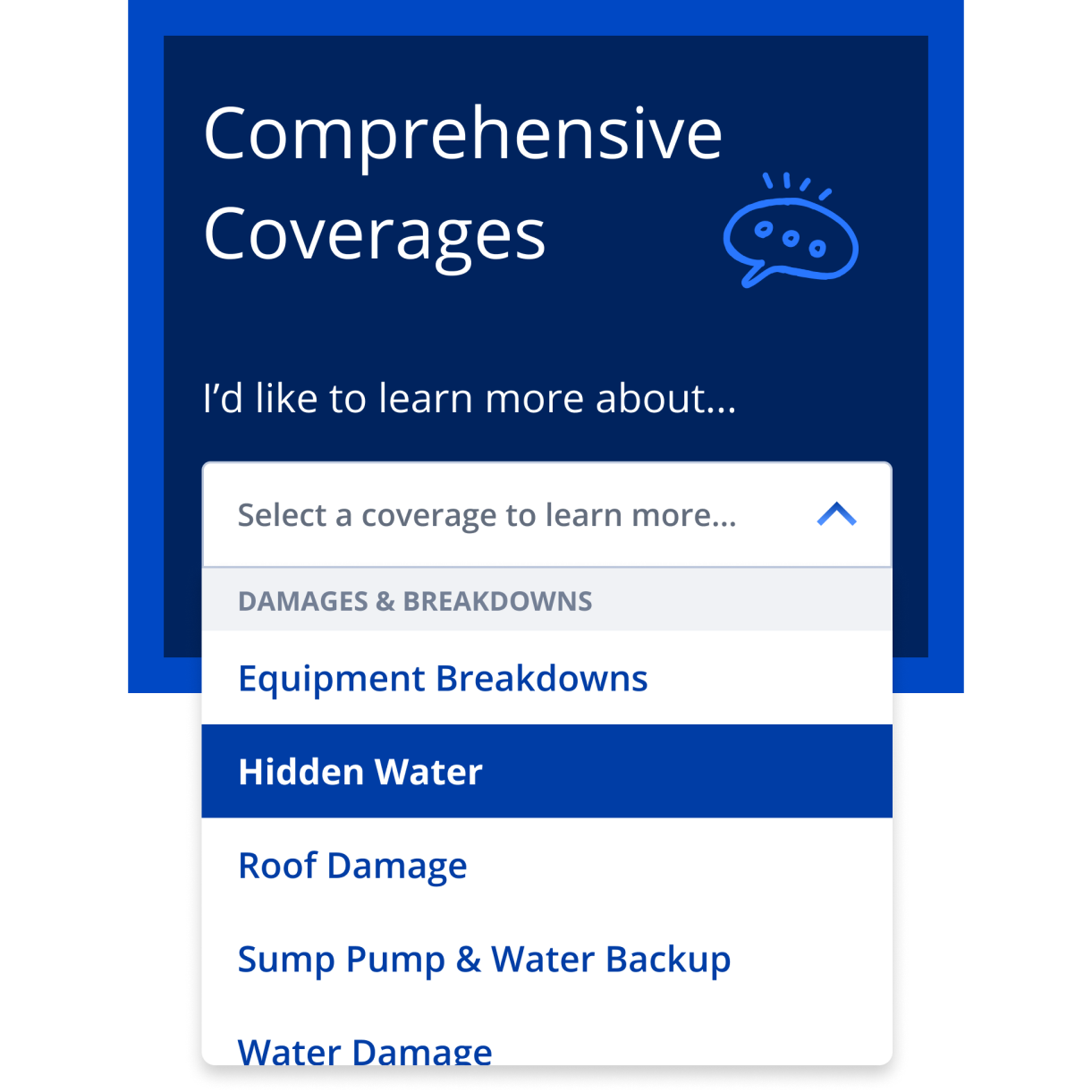

Leveraging new technology for a quicker more accurate quote

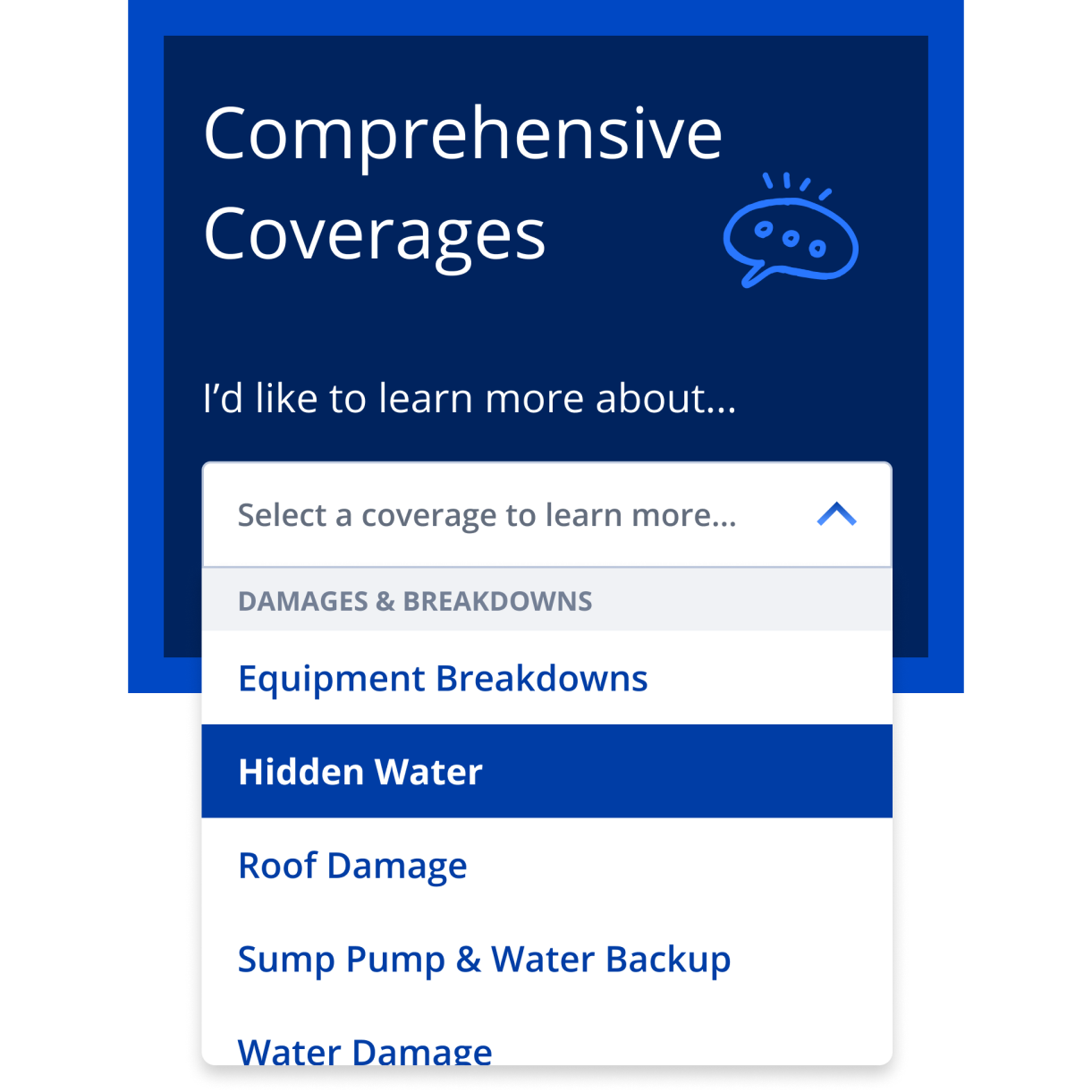

Future-state quote flows ask one question at a time and offer smart alternatives to laborious, form-based data entry. Users can upload photos of their home rather than try to make confusing distinctions about building materials and structures themselves.

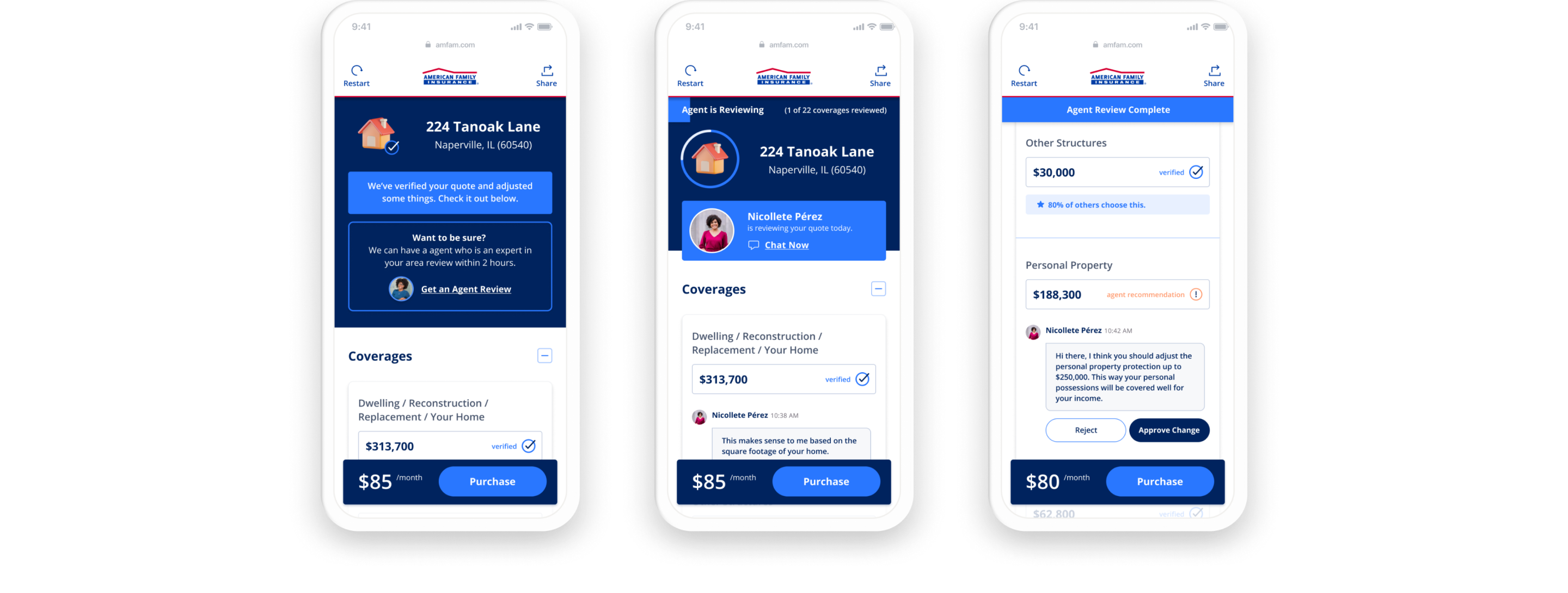

Connecting customers to real agents to look over their quote.

Forward-looking quote concepts addressed the wish for expert oversight of important purchases that was identified in the research phase. This was a great example of technology supporting an relationship-based customer experience.

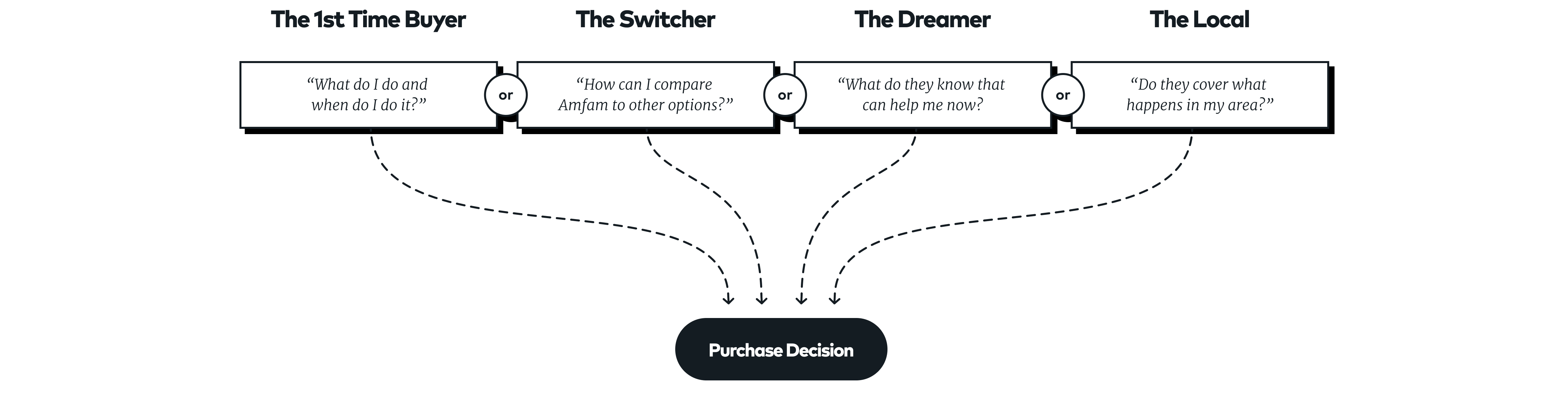

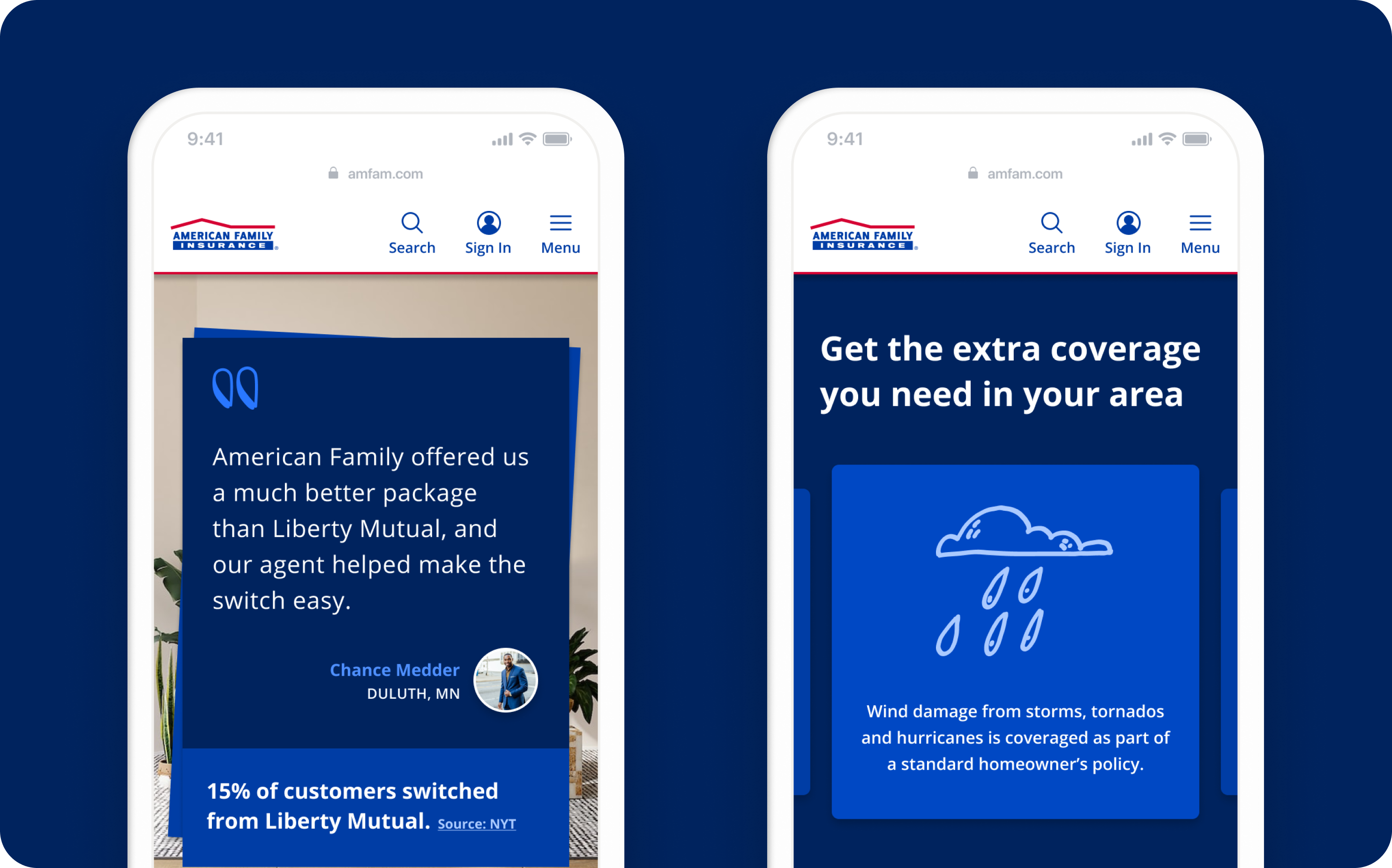

Shopping experiences targeted to different stages in the home buying and ownership cycle

First-time home buyers, who often need to make homeowners insurance decisions in the middle of the stressful and sometimes chaotic weeks of closing, need fast answers and guidance. Those considering switching insurers, or just getting started in their home buying journey benefit from different types of information and expertise that insurers are uniquely positioned to provide.

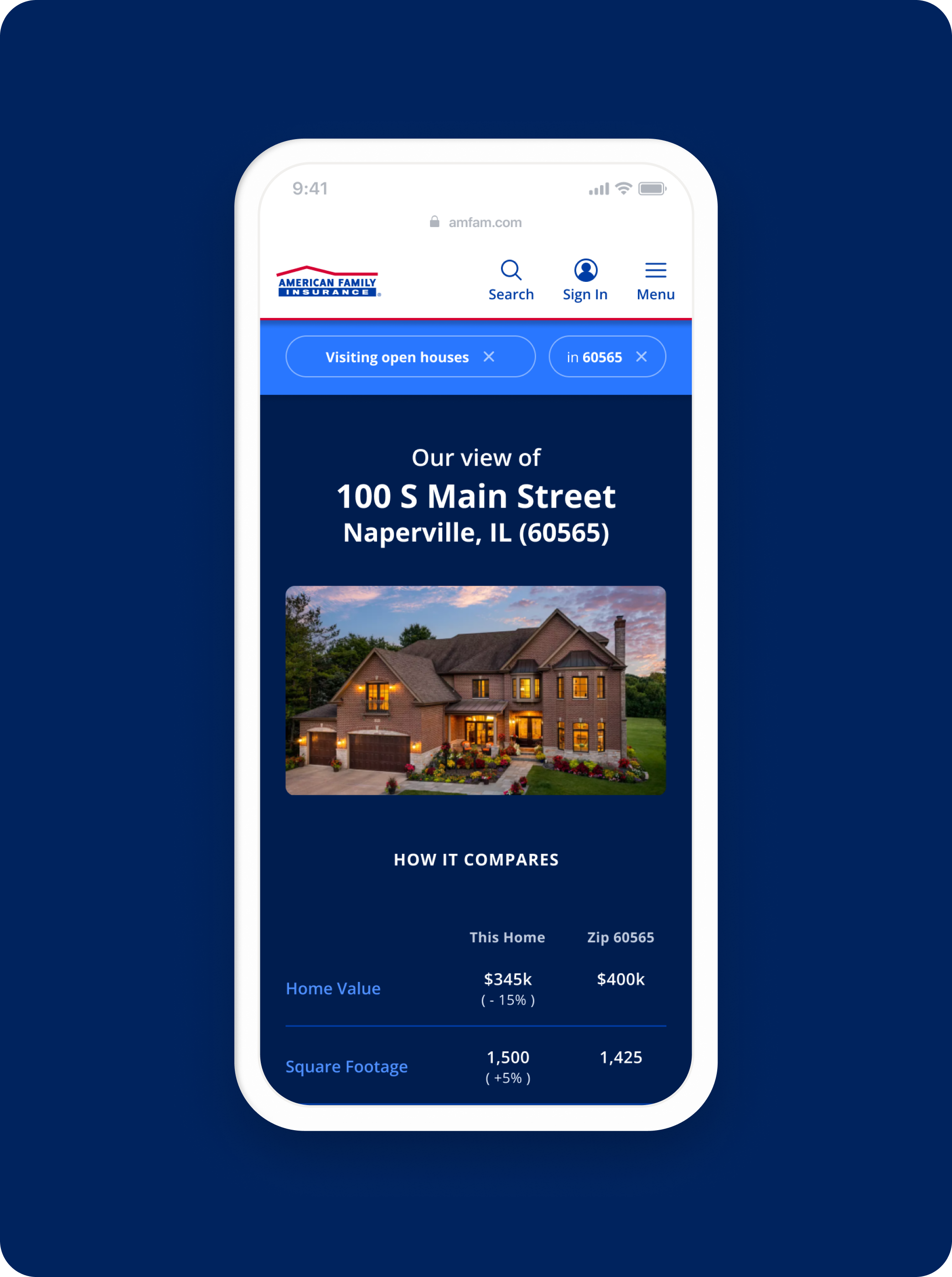

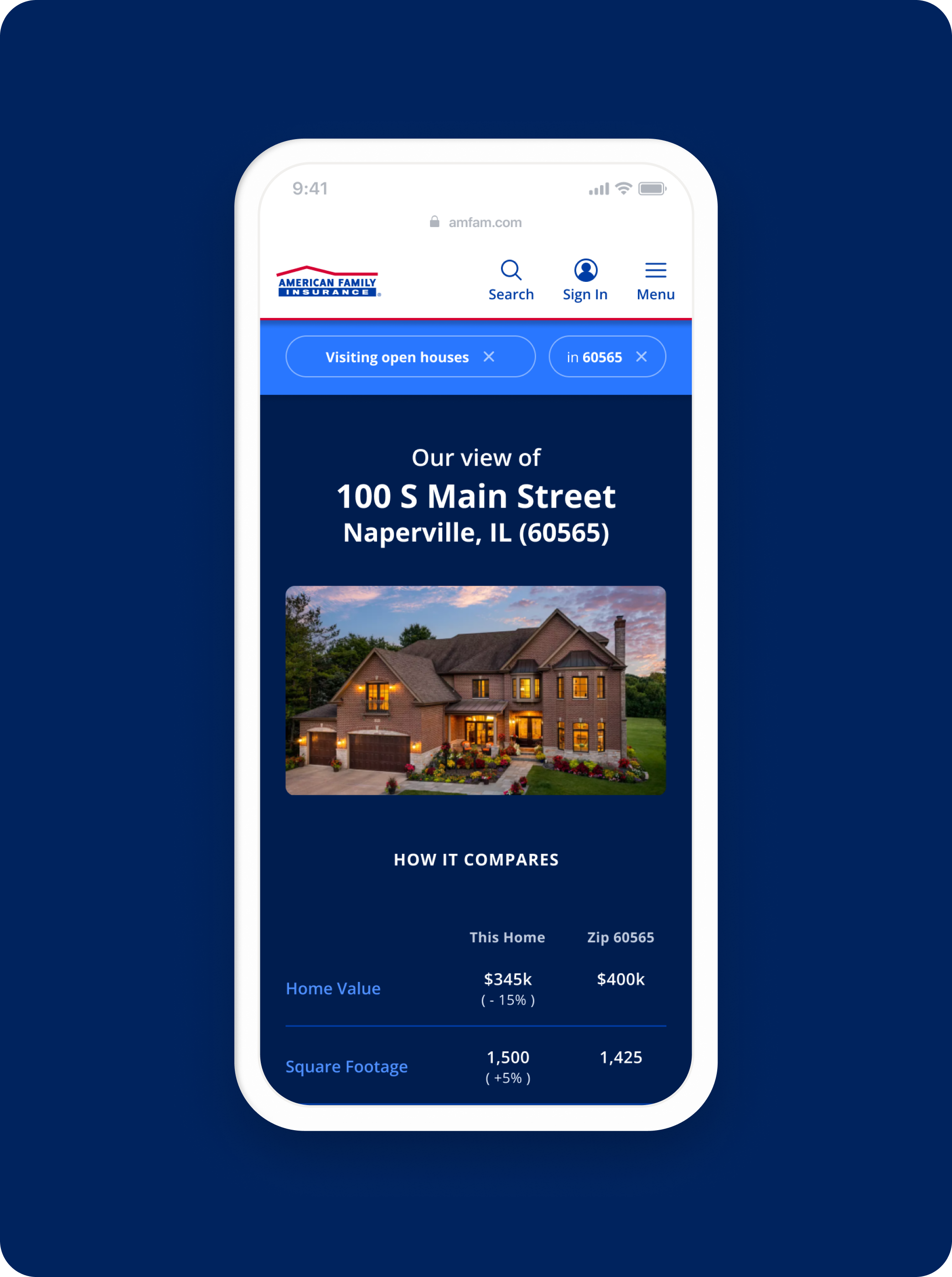

Surfacing aggregate customer data to support home-buyers early in their process

Surfacing aggregate customer data to support home-buyers early in their process

We’re able to drive some very actionable outcomes. I’m very appreciative of that.