Validating a small commercial opportunity: Higher volume sales, lower effort service

The Hanover, a leading property and casualty insurer selling through select independent agents, saw an opportunity to expand their small commercial business through digital transformation.

They speculated that legacy systems and clunky user interfaces were holding the business back—inflating the amount of manual work required to service each of these lower-premium policies out of proportion to their individual business value.

The hypothesis: A more streamlined, intuitive quote, bind, and servicing system would enable independent agents to work with Hanover more frequently, and free up underwriters and internal employees to devote more of their time to higher value work.

Our charge: To dig deeper and perform a UX assessment of the current agent and underwriter experiences, validating the hypothesis and identifying specific areas of opportunity and improvement that could lead to more efficient sales and servicing.

User Research

Experience Strategy

A human-centered UX assessment

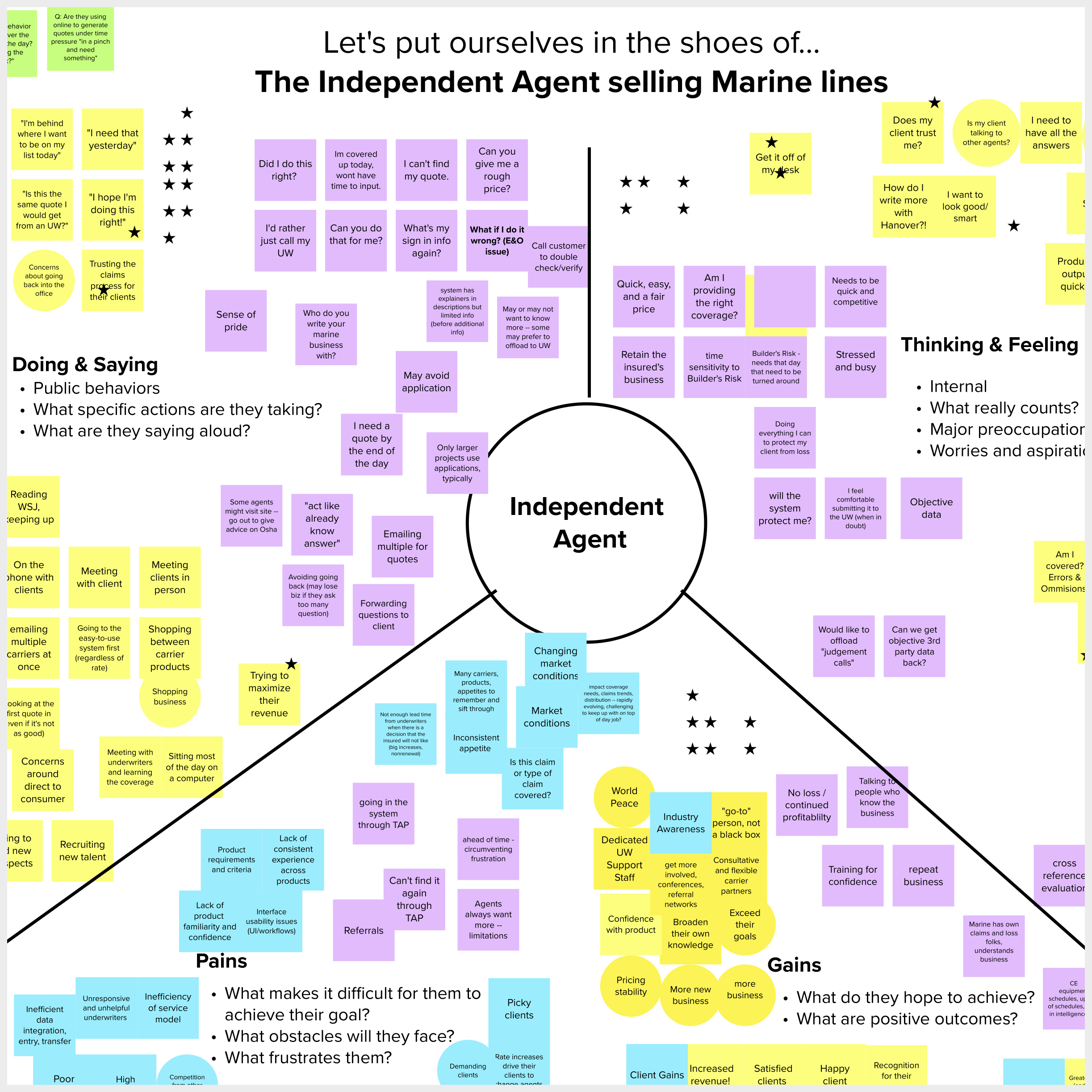

To get a first-person feel for the current experience, C&A researchers logged in and played the role of the independent agent. The team participated in live training sessions and workflow walkthroughs—learning to navigate across the several separate systems The Hanover currently provides to allow for self-service submissions, quoting, and policy binding for various small commercial lines, including Inland Marine, Professional Liability, and Cyber.

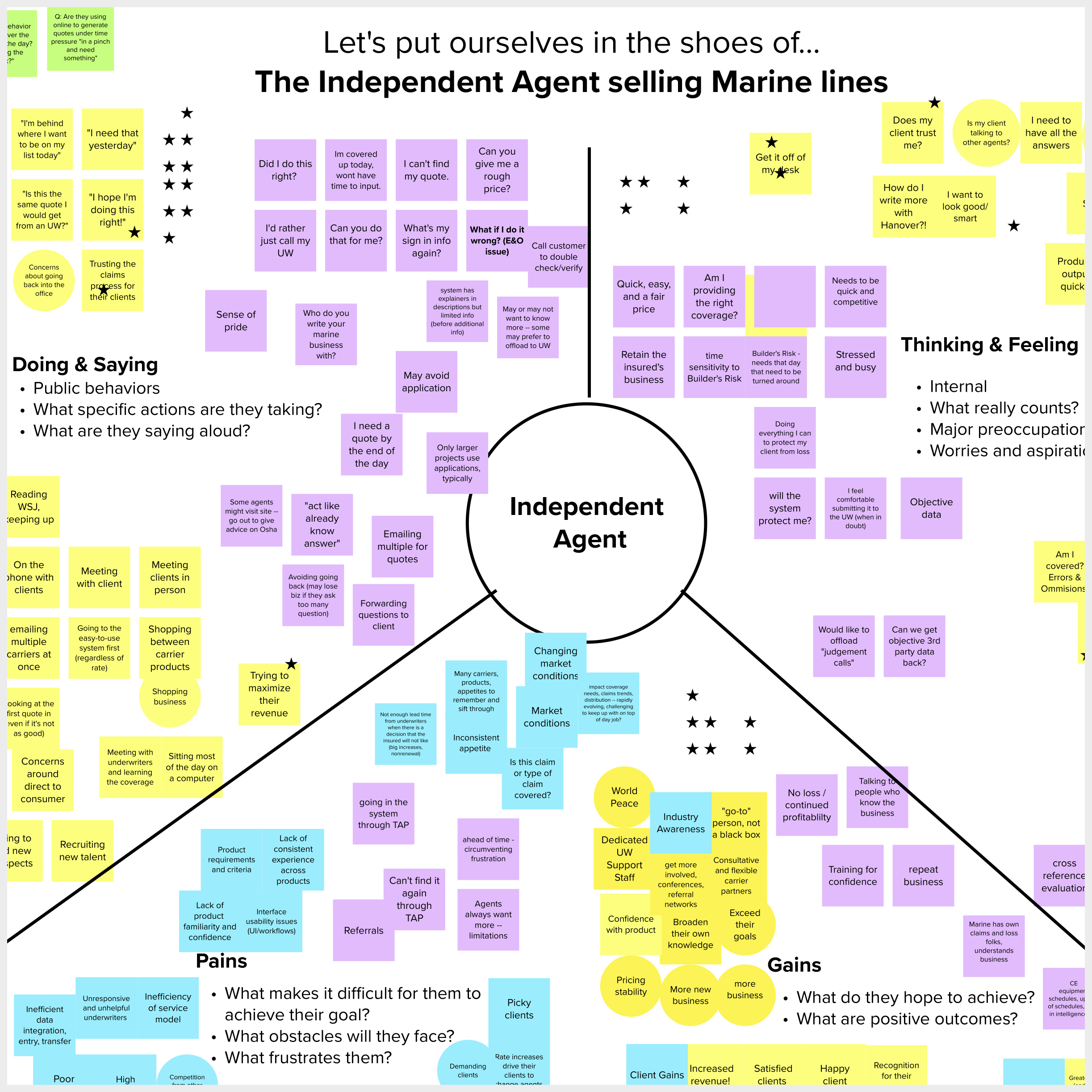

Next, with empathy derived from our hands-on discovery, we met with representative independent agents and The Hanover underwriters. During guided, 1:1 discussions, we listened as they talked through their interactions with the systems and each other. They shared preferences and concerns — painting a clear picture of their attitudes toward and appetites for using self-service platforms.

Through these candid conversations, team quickly surmised that rebuilding and streamlining the self-serve online “agent portal” might improve some outcomes, but would not be the most direct way to positively impact the agent experience, nor was it likely to significantly reduce underwriter workloads. Agents and underwriters both viewed the accessibility and responsiveness of The Hanover team as a key differentiator in the marketplace. They saw little need for a fully automated process, suggesting that it could in fact undermine the value proposition.

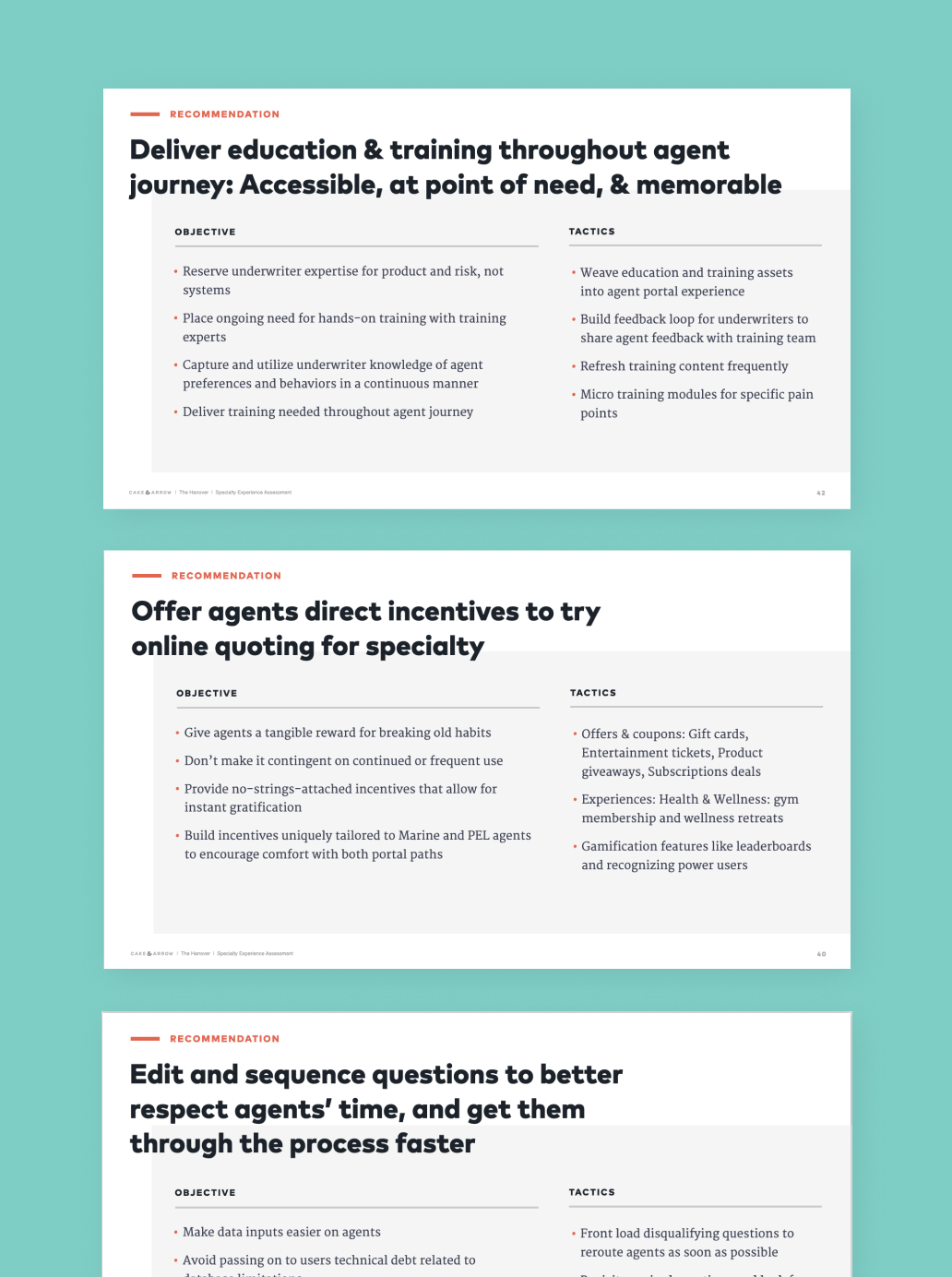

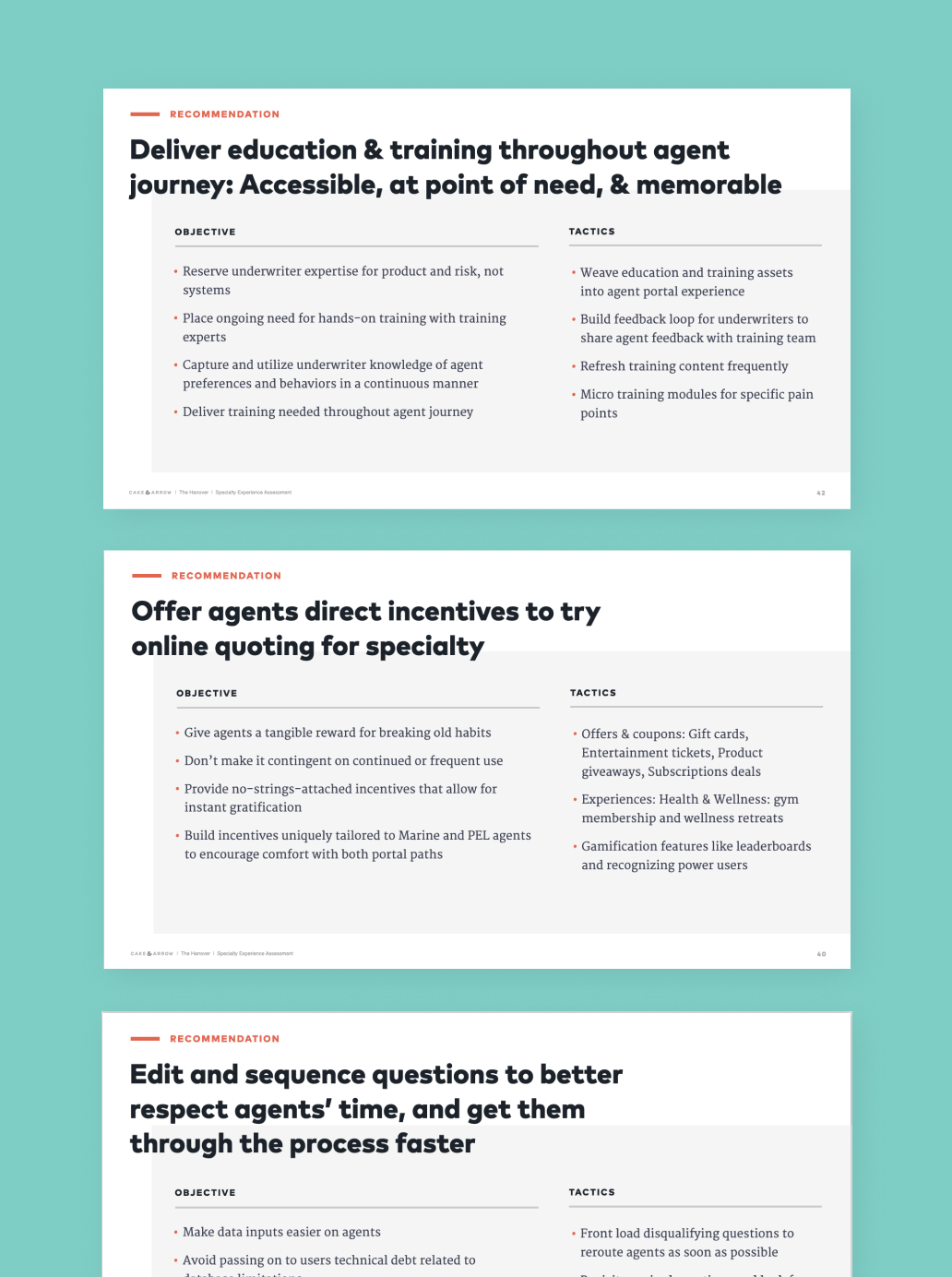

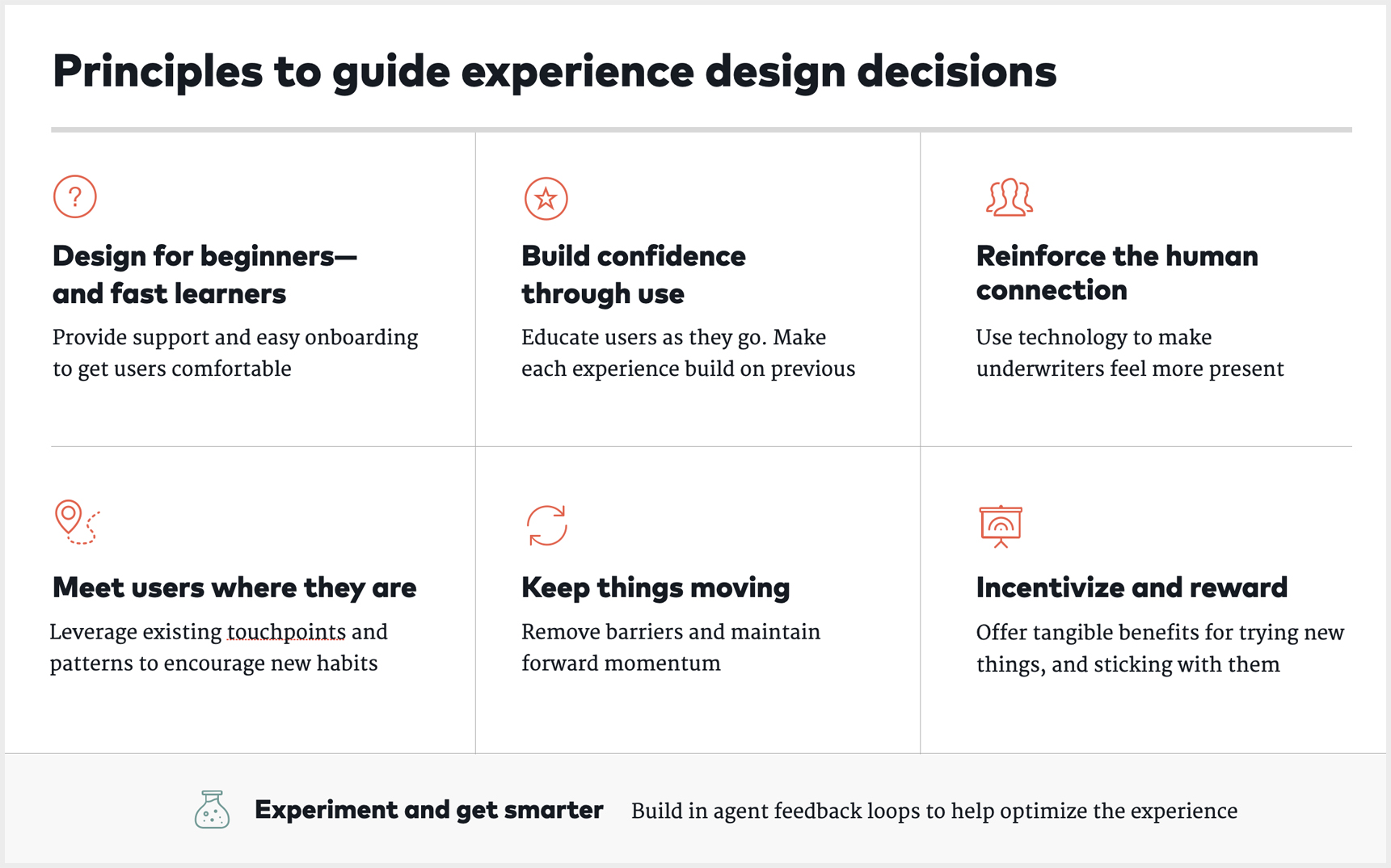

Within this broader insight, however, the team identified key areas where technology could better support IA and underwriter interactions — educating agents to build confidence selling unfamiliar products, providing “live chat” support and collaborative tools to work through the trickier aspects of submission together, and better integrating with email and other external tools to more seamlessly fit into typical workflows.

By taking a more expansive view of “user experience” and viewing the role of technology through a human-centered lens, C&A researchers were able to deliver insights that will help The Hanover develop a more transformative vision of how to grow its small commercial business while remaining true to the brand promise. And with a clearer view of internal and external users, the internal team can better prioritize and roadmap near-term portal optimizations that build toward longer-term goals.

“If behavior is the cornerstone of how we design things, we’re able to show them that even as things change along the way we’re still listening…”

The Hanover stakeholder, summarizing takeaways

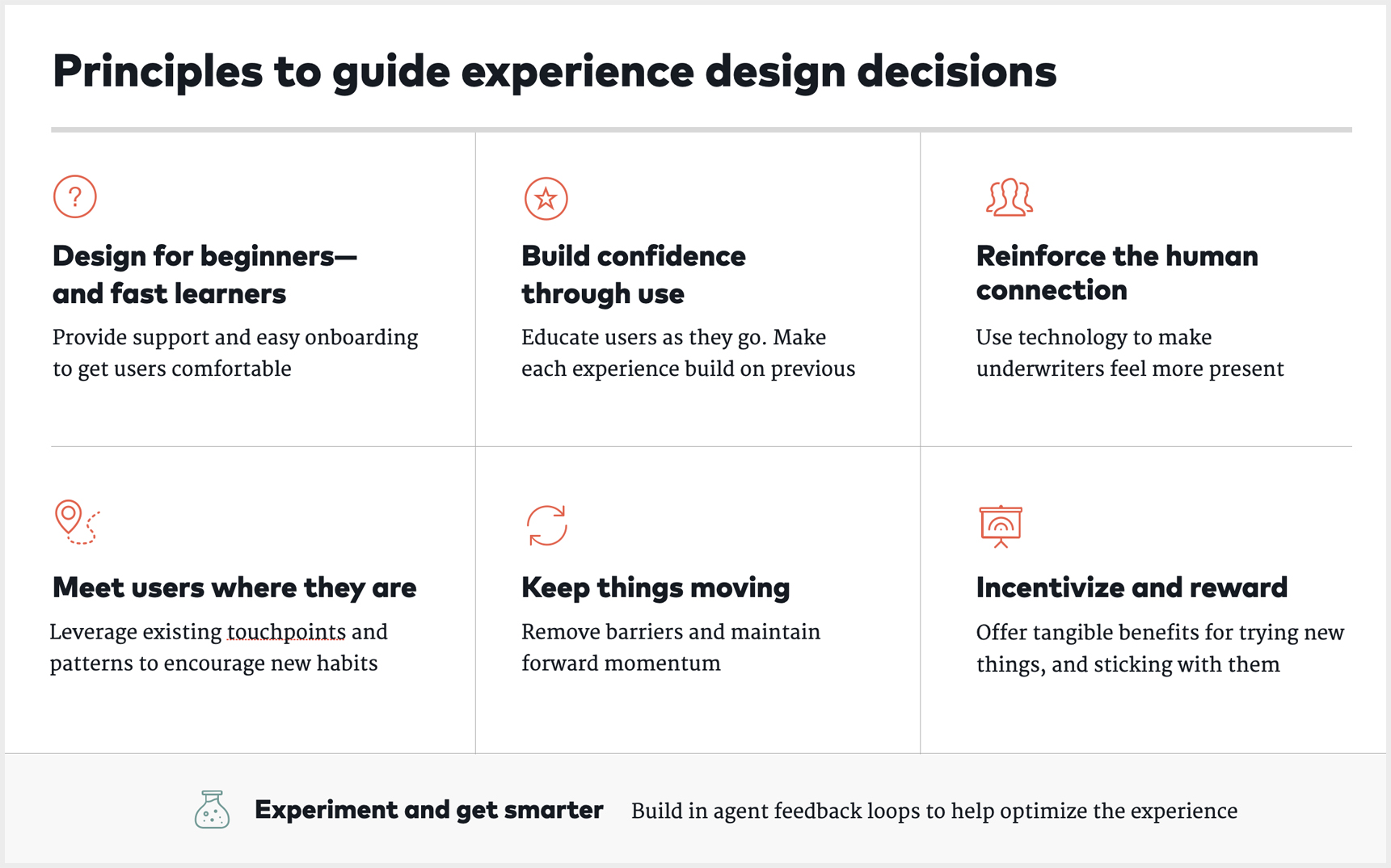

Empathy drives experience principles to better serve the independent agent

Empathy drives experience principles to better serve the independent agent

“Cake & Arrow has opened my eyes personally to the agent behavior; the human behavior that we interact with needs to be at the forefront of how we think about designing this stuff.”