As those of you who follow our newsletter know, we are currently in the middle of a Gen Z research study. We are surveying and talking to Gen Z, aiming to understand how the insurance industry can attract more Gen Z customers and talent. We’ll release our full findings via a report later this month, but in the meantime, we wanted to share something interesting we turned up.

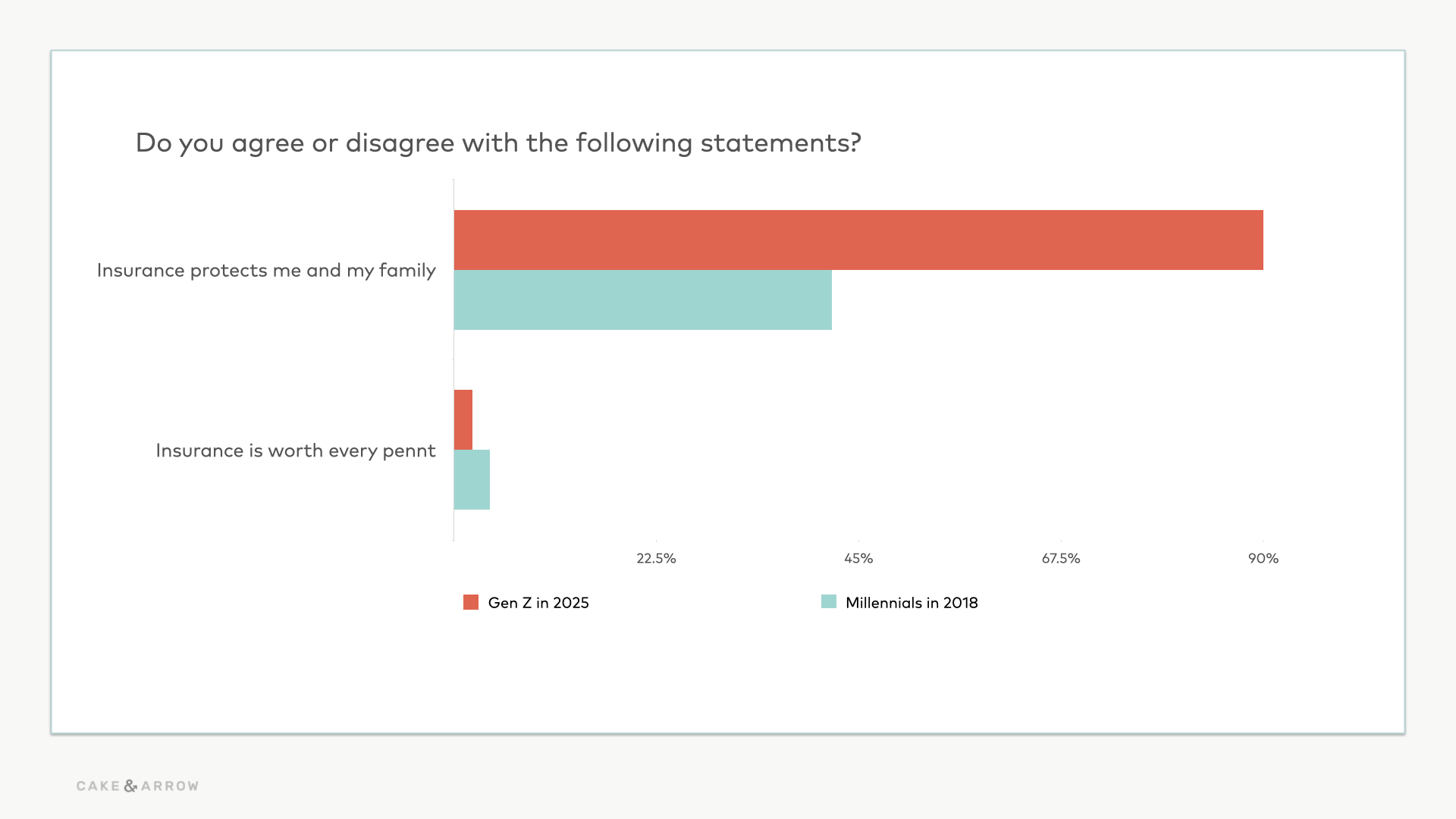

When we asked Gen Zers to respond to a series of statements about insurance with an agree or disagree, we stumbled upon what, at first glance, may appear to be a surprising paradox.

92% agreed with the statement “insurance protects me and my family.”

2% agreed with the statement “insurance is worth every penny.”

We are calling this the Gen Z value gap—it’s the gap between the idea of insurance and the experience of it. Between appreciating the protection it offers, but not wanting to pay the price tag for it.

It’s a striking gap—but not an unfamiliar one.

Seven years ago, in 2018, we asked Millennials (who, notably, were about 10 years further into adulthood than GenZers are now) a similar question.

42% agreed with the statement “insurance protects me and my family.”

4% agreed with the statement “insurance is worth every penny.”

While these comparisons are clearly not apples to apples, the gap persists and (as with so many things pertaining to Gen Z) has become even more extreme, with the gap 52% wider than it was when we surveyed Millennials in 2018!

So what is this paradox—and this expanding gap really about?

A closer look at the data and a deeper understanding of who Gen Z is as a generation and where they are at in their lives in comparison to Millennials back in 2018 may reveal more.

From belief to disillusionment

The first thing to note is obvious: Gen Zers are young. The oldest person we surveyed was 28 and the youngest was 18. Due to this, their experience with insurance is likely more limited than it may have been with Millennials when we surveyed them (they were between the ages of 22 and 37 at the time).

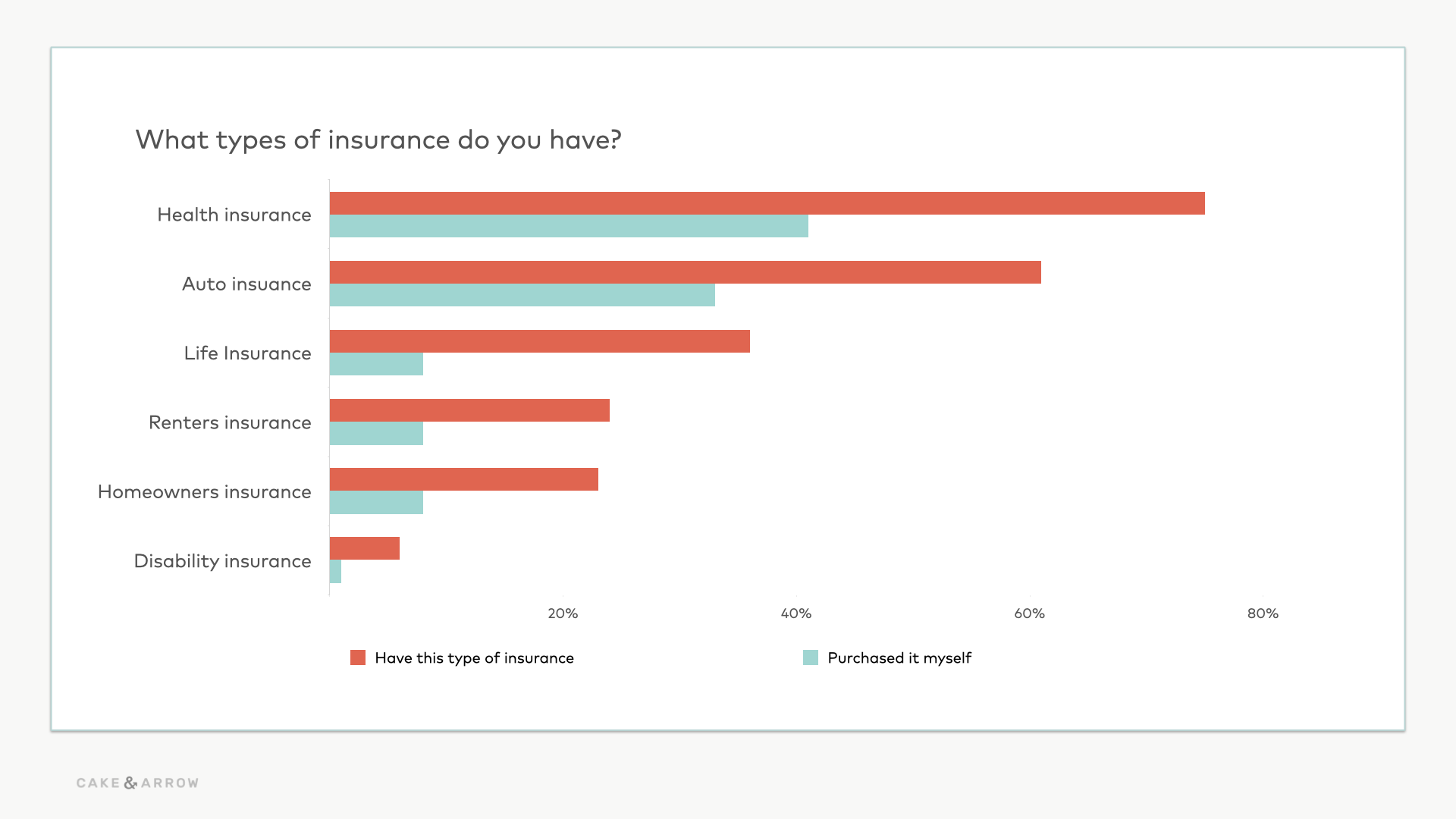

Many of the Gen Zers we spoke with were still on their parents’ health insurance and car insurance. Below, you can see the breakdown of what kinds of insurance they have vs. what kinds of insurance they themselves have actually purchased.

Being so young, some have had few opportunities to even use their insurance. So for them, the promise of insurance is more hypothetical as they haven’t necessarily been able to test the strength of that promise.

Millennials in 2018, some of whom were as old as 37, had theoretically had more experience of using their insurance (and may have felt more disillusioned about its promises). This might explain the 52% gap between Gen Z and Millennials.

Ultimately, for Gen Z, that strong sense of feeling protected by insurance might be accounted for by two things:

- Greater financial instability. Being young and financially insecure might make insurance feel more important, as they are, at least in theory, less likely to be able to absorb a major financial catastrophe than they might be at a later stage in life.

- Less experience. Having insurance and using insurance are two very different things, obviously. Those who file insurance claims, depending on the outcome, might, as our recent claims research found, feel disillusioned by the promise of insurance, having to fight for reimbursements etc.

What price do you put on protection?

Now specifically for the Gen Z gap. Why, if 92% agree that insurance protects them do only 2% agree that its worth every penny?

The most straightforward conclusion is that the feeling of protection really isn’t that worth that much. While products like health insurance might offer more tangible, present-tense value, most other types of insurance offer little in the short-term beyond the sense of security.

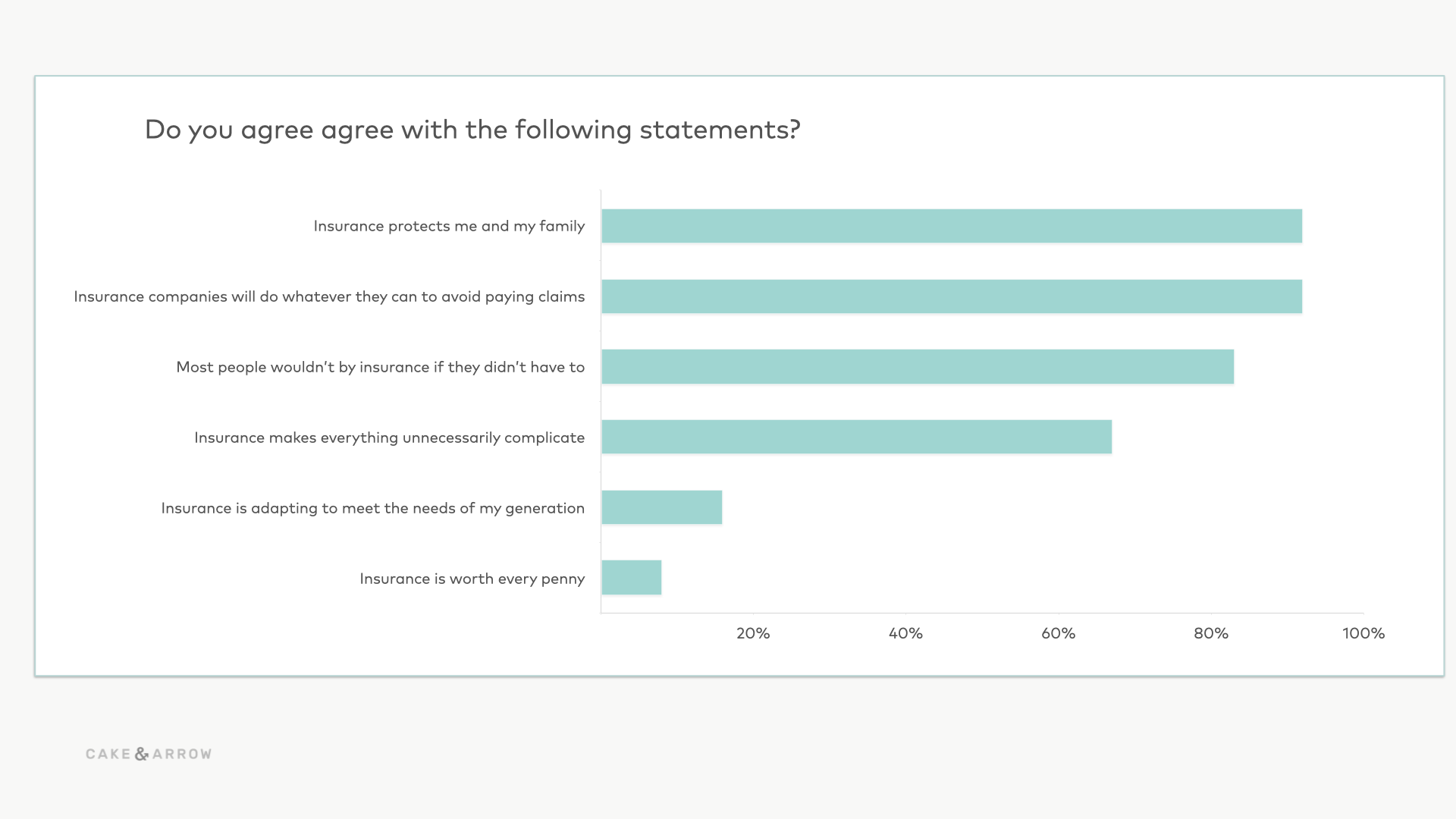

And although 92% agreed that insurance protects them, a closer look at the data suggests cracks in this confidence.

92% also agree that insurance companies will do whatever they can to avoid paying claims, 83% agree that most people only buy insurance because they have to, and only 16% agree that insurance is adapting to meet the needs of their generation.

Looking at these results together makes the only 2% who see insurance as being worth every penny much more legible.

In short, the sense of protection really isn’t worth that much, especially when you factor in skepticism around claims and the fact that insurance is offering little else to Gen Z beyond this shaky guarantee.

Layered on top of this are the strong antisystem vibes we (along with a lot of other people) have observed with Gen Z, many of whom possess a deep distrust of institutions, from the government to insurance companies, and skepticism about what these institutions can really do for them. As Gen Z author and content creator Kyla Scanlon has written,

Young people feel a broken social contract: effort and patience no longer guarantee security or opportunity. The result is a kind of presentism (sports betting, meme trading) instead of planning for a future that feels out of reach. For a young workforce facing these barriers, it’s logical to tune out or embrace an “antisystem” candidate who at least acknowledges their desperation, reinforcing the cycle of futurelessness.

Kyla Scanlon, Gen Z author and content creator

And finally, it’s hard to talk about value without acknowledging the elephant in the room: for Gen Z, the rising cost of living is, according to our research, the biggest threat to their generation. Cost of living, inflation, increased housing costs, and economic concerns were major themes in our research.

When you’re living paycheck to paycheck and just trying to stay ahead of the rising cost of living, even everyday expenses can feel like a strain—let alone a shaky promise of protection against some future what-if. Why would insurance feel like it’s worth every penny when you’re focused on staying afloat?

But this is also what makes the Gen Z value gap so thorny.

For Gen Z, not having insurance feels dangerous, more dangerous, perhaps, than it does for other generations whose finances are more stable and more predictable—but it also feels unaffordable, impersonal, or unreliable. They’re stuck in a lose-lose calculation.

What would it take to close the Gen Z value gap?

It’s simple, in theory: provide more value. If the shaky promise of protection doesn’t feel meaningful, what does?

Our research suggests one answer: a sense of self-reliance.

Gen Z doesn’t want to depend on a distant institution to decide whether they “qualify” for help. They want tools that help them help themselves—resources that build their confidence, grow their resilience, and support their financial goals in the here and now.

When we tested different ways of framing insurance, the concept of a “resilience builder” resonated most. It didn’t sound like insurance—but maybe that’s exactly the point. Gen Z isn’t just looking for something to catch them when they fall. They’re looking for something that helps them stand taller, plan smarter, and confidently move forward.

As one Gen Zer we spoke to put it:

I don’t feel like my insurance has ever given me any kind of strategy for long-term smart planning or support when dealing with a financial burden or strengthening my financial confidence.

Ethan, 28, Qualitative Research Participant

Could insurance evolve to offer that?

If the industry is serious about closing the value gap, it might have to.